-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- INSIGHT LAB

FEATURED

April 1st, 2024Charging ahead: navigating the dynamic evolution of the UK’s electric vehicle market in 2024March 11th, 2024Tech Century: From Dots on a Map… to Guiding Short- and Long-Term EV SuccessMarch 4th, 2024Targeting tyre opportunity to help stabilize the impacts of a shifting industry on retailer service departments - NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

Urban Science Annual Index:

dealer relevance declines in eyes of auto buyers

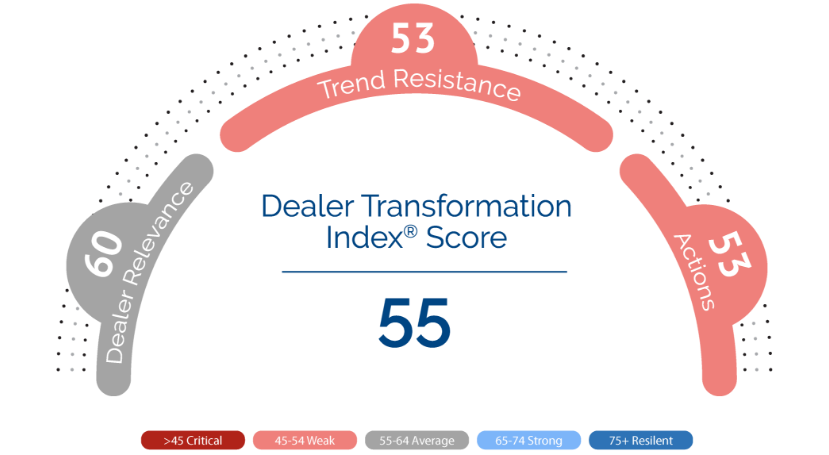

Insights from the 2023 Urban Science Dealership Transformation Index™ (DTI)1 are in, and while the overall index score remains unchanged, one key metric, dealer relevance, has dropped three percentage points, while another, trend resistance, has gone up five percentage points. How have these two findings impacted auto-buyer behavior? They haven’t, at least in strict terms of auto-buyer actions. But there’s more to the story, and much more to analyze between the lines of these statistics.

June 19th, 2023

The Dealership

Transformation Index:

what it is and why it matters

Urban Science has teamed up with The Harris Poll – a leading global market research and consulting firm – to conduct ongoing, comprehensive research on the state of the automotive industry through the eyes of dealers and auto buyers.

The DTI is the result of that collaboration. Now in its second year, this index is fueled by a science-driven methodology for capturing and analyzing the evolving views of the auto-buying public as they relate to the traditional automotive dealership network regarding sales and service.

The DTI score – and the research that drives it – empowers OEMs and dealers to identify trending issues and opportunities, and to tap the power of actionable insights that will better position them to elevate their brand experiences for auto buyers while simultaneously enhancing efficiency and profitability across their operations.

The 2023 DTI findings highlight important perspectives across both auto buyers and dealers.

Dealer Relevance

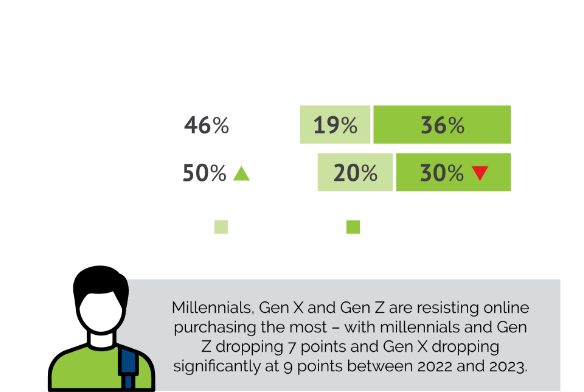

Millennials most likely to look for alternative ways to purchase

Dealer Relevance measures how auto buyers feel about the collective role of dealers and their expertise, and other related aspects of the increasingly complex vehicle-buying journey. When it comes to how auto buyers view dealer relevance, the year-over-year (YoY) drop from 63 to 60 – on the surface – may seem small. The number driving that drop, however, was a more concerning five-percentage-point decline in that category among millennials. In other words, the key buyer demographic for dealers both now and in the coming years is the one most likely to look for alternative ways to purchase a new vehicle.

Auto buyers and dealers less confident car dealerships are optimized for the future

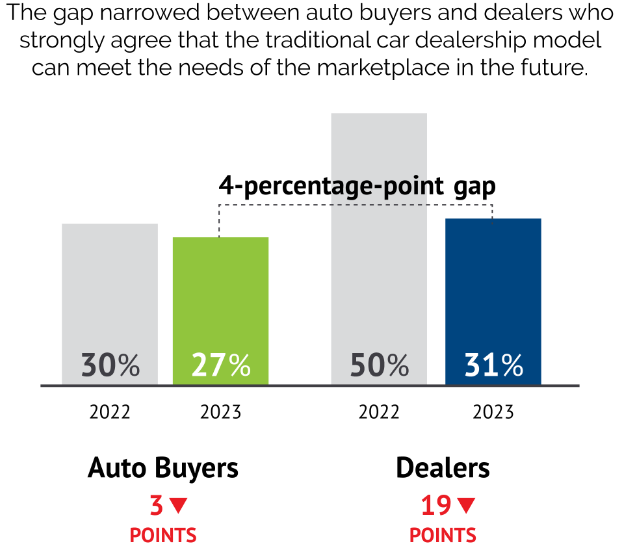

The 2022 DTI revealed a significant misalignment between how auto buyers and dealers viewed dealership optimization regarding the marketplace of the future. At that time, less than one-third of auto buyers (30%) were optimistic about dealerships being completely optimized for what the marketplace needs in the future versus how dealers themselves – at 50% – felt. In this year’s study, both auto-buyer and dealer perceptions have declined, with just 27% of auto buyers saying dealerships are optimized for the future and 31% of dealers echoing those sentiments, narrowing the perception gap to just four percentage points. That represents a dramatic 80% decrease in the gap in just one year.

The growing gap between auto buyers and dealers regarding salespeople’s expertise in the complex vehicle-buying process

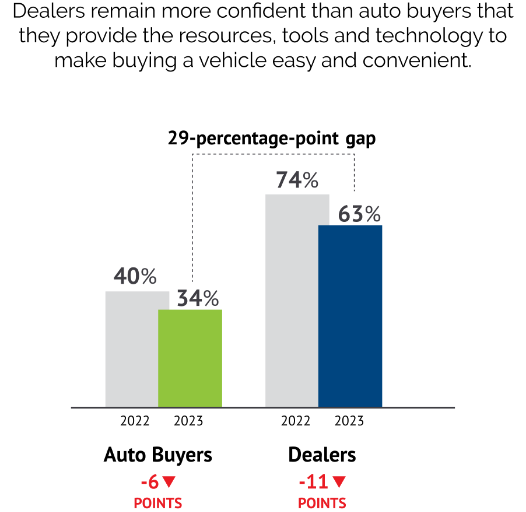

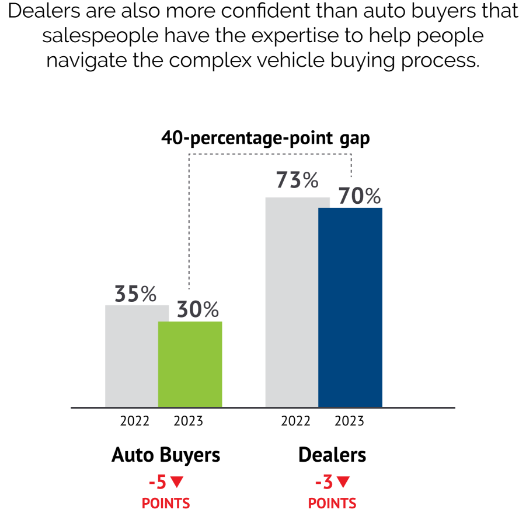

The previously mentioned views regarding dealership optimization reflect another finding from the DTI, which revolves around perceptions of the essentialness of today’s dealerships in the auto-shopping and -buying process. In this category, only 34% of auto buyers strongly agree “today’s dealers provide the resources, tools and technology to make buying a vehicle easy and convenient,” down six percentage points from last year. Even fewer auto buyers (30%), think salespeople have an expertise necessary to help them “navigate the complex vehicle-buying process.” The gap between auto-buyer perceptions and those of dealers in these two categories is significant, at 29 percentage points and 40 percentage points, respectively. Narrowing those gaps is critical to ensure sellers are a valuable asset in consumers’ brand experiences.

While the DTI has helped identify opportunities for improvement, it also spotlights the value auto buyers see when it comes to in-dealership engagement.

Trend Resistance

Year-over-year findings show auto buyers resisting popular trends

Trend Resistance measures how likely auto buyers are to resist new innovations in the automotive retail space, from new-vehicle technologies to their car-shopping and -buying experiences. This year, there was significant auto-buyer resistance to being open to “purchasing a vehicle fully online.”

The reality is more reflective of the motivating factors behind these beliefs, and the experiences by both auto buyers and dealers that are helping them form their opinions.

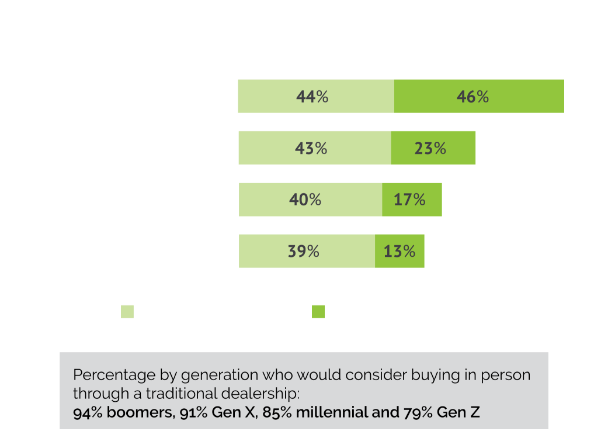

90% of auto buyers still prefer in-person shopping at traditional car dealerships – a trend that’s strongest among Gen X (91%) and boomers (94%). Interestingly, for buyers gravitating toward full-digital retailing, 65% prefer a traditional dealership’s website over a manufacturer’s website (at 57%).

Actions

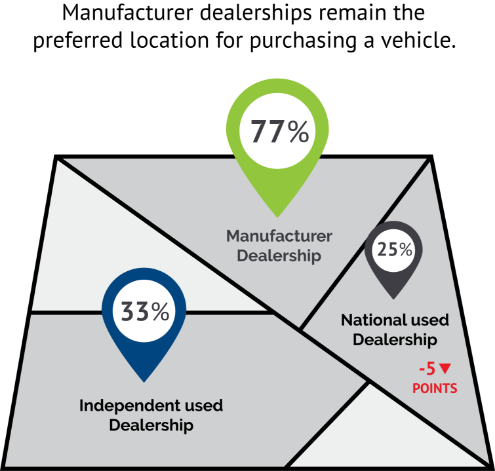

Manufacturer dealerships still the top choice for auto buyers

Actions describe what auto buyers are doing – or considering doing – regarding their vehicle purchases, from visiting a dealership to submitting online quotes. The 2023 DTI showed the way auto buyers are engaging with dealerships hasn’t changed YoY. They’re still much more likely to consider manufacturer dealerships over independent or national used dealerships. In fact, their interest in national used dealerships has actually declined five percentage points since the 2022 survey.

In general, auto buyers in the study report they either have visited or plan to visit an average of 1.9 dealers, and 46% have asked or plan to ask for a price quote online. It’s clear auto buyers aren’t shying away from in-dealership engagement. In fact, based on their actions, they’re taking a hybrid approach: researching and asking for a quote online, then visiting a dealership to test drive and/or complete the transaction.

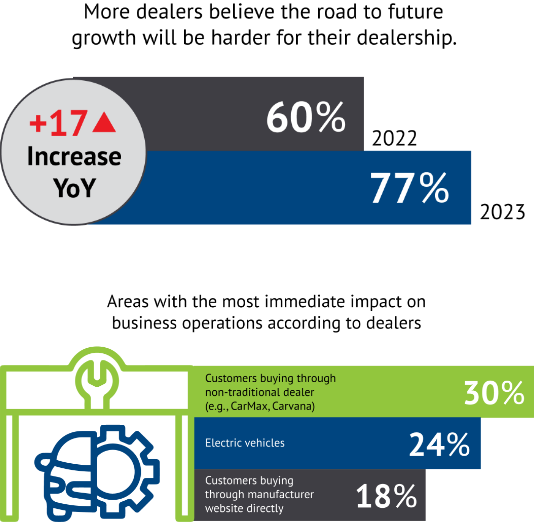

The difficult road ahead for dealers

Dealers want to embrace the future with the right tools and expertise, particularly as the industry moves toward EVs, and in fact, sellers don’t disagree with consumer sentiment around questioning traditional norms. Since 2022, however, with threats to their operations coming from nontraditional dealers, nontraditional purchase models and the industry’s rapid transition to electric vehicles, dealers are significantly more likely to describe their path to future growth as “harder.”

The DTI outlines a path to the future – but it won’t be easy. It will require dealers to focus on the opportunities behind the challenges, and to find ways to evolve with the customers they have (and the prospects they’re hoping to turn into customers) and meet them where they are on their purchase journeys. Sellers must embrace the changes that are coming in ways that are confident and innovative, and communicate the actions they’re taking to create a more seamless and convenient experience to their target audiences.

Science as a solution

Since our founding over four decades ago, our unrivaled near-real-time industry sales data, and consulting and technology offerings, have driven innovation, efficiency and profitability into every corner of the automotive industry. Our capabilities and industry expertise help OEMs and dealers, and the advertising technology firms that support them, stay ahead of industry trends and achieve business certainty in even the most chaotic market conditions.

Looking ahead, we’ll report on a multitude of areas of opportunity related to our DTI research, revealing additional auto-buyer and dealer insights that can guide OEMs and dealers to science-driven strategies that will improve performance. Look for our insights regarding omnichannel retailing, new retail formats, dealership service, consumer purchase behaviors and dealership performance measurement soon.

In the meantime, if you’d like to talk to someone at Urban Science about how we can guide your organization to new levels of efficiency and profitability across your retail network or within your franchise store(s) through our unmatched data and industry expertise – or if you have any questions about the information included in this article – please contact us now.

Read next article

1. This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,022 US adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 250 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner.

The auto-buying public survey was conducted from January 26 to February 15, 2023. Data are weighted where necessary by age by gender, race/ethnicity, region, education, marital status, household size, household income, and propensity to be online to bring them in line with their actual proportions in the population. The dealer survey was conducted January 26 to February 17, 2023. Results were not weighted and are only representative of those who completed the survey.

Respondents for this survey were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +2.6 percentage points for auto-buyers and +6.2 percentage points for dealers using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest.

All sample surveys and polls, whether or not they use probability sampling, are subject to other multiple sources of error which are most often not possible to quantify or estimate, including, but not limited to coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments.