-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- RESOURCES

- NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

July 1st, 2025

Three ways defection data can enhance your dealership’s sales effectiveness

In today’s climate of economic uncertainty and omnichannel shopping, staying aligned with your customers’ needs is key. Currently, heightened demand — paired with the looming risk of price increases — is giving dealers greater leverage, even as affordability concerns threaten consumer purchasing power. Our recent study shows affordability is the top concern for today’s auto buyers.* To stay on track amid market disruption, dealers will need to maintain a fresh and accurate sales pipeline to stay on track and ensure every resource is used effectively.

Customer relationship management (CRM) systems play a vital role in helping dealerships manage their operations and drive sales. However, their effectiveness depends on the quality of the data they contain. Missing or incomplete data leads to ineffective outreach, wasting valuable time and money. CDPs can provide holistic insights but require high quality data integrations to do so.

One powerful but often overlooked tool is defection data — insights into when and where your leads buy from other dealers. It helps pinpoint gaps in your sales process, marketing and customer experience.

In this article, we explore three ways defection data can enhance the management of your sales pipeline and processes, drive higher conversions and improve efficiency.

1. Strengthen and clean up the data in your sales pipeline

Incomplete or outdated CRM lead records can significantly hinder salesperson engagement and productivity. Poor data hygiene wastes valuable time, leads to poor consumer experiences and underwhelming close rates. Missing contact details or unclear customer preferences make it difficult to understand and meet shopper needs, while outdated information causes teams to chase leads who are no longer in-market. These inaccuracies drain critical time and enthusiasm that could be better utilized pursuing customers who are still ready to buy.

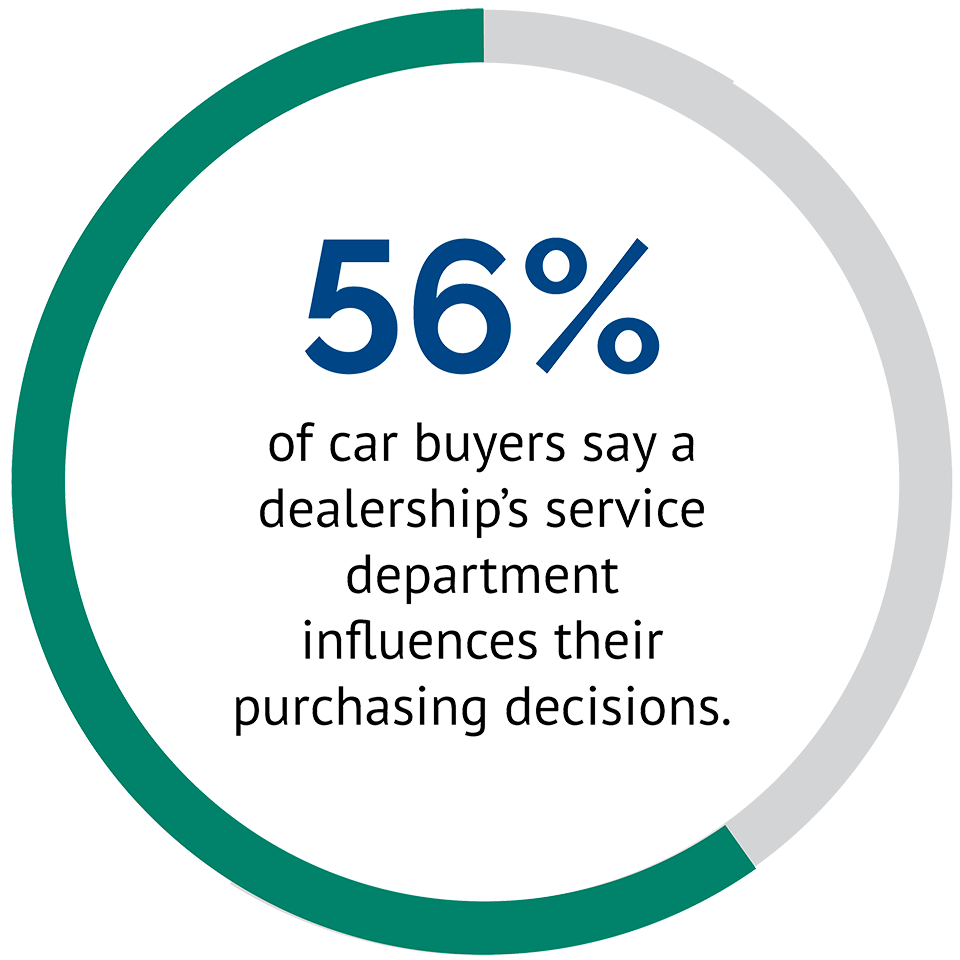

Defection (lost sales) data delivered daily identifies out-of-market leads so your sales teams can focus on customers who are still shopping. Just as importantly, it creates an opportunity to re-engage defected leads with relevant service offers — meeting customers where they are in their ownership journey. This not only saves time but also enhances your brand’s reputation by avoiding unnecessary sales outreach and instead offering value through more relevant outreach. This is especially important considering that 56% of car buyers say a dealership’s service department influences their purchasing decisions, making service a critical strategy for building customer loyalty and long-term retention. Alternatively, you can send a survey asking why they defected, providing valuable insights to improve your retention strategy and follow-up processes.

If your CRM isn’t already enhanced with defection data, now’s the time to strengthen your tech stack. Adding SalesAlert and enabling its integration can help automatically flag out-of-market leads, keeping your pipeline clean and focused. Also, consider using a CDP or another data hygiene tool to help ingest, unify and enrich customer data from multiple sources — ensuring a single, accurate view of each lead across your systems. These tools ensure your sales team has the most up-to-date and accurate information to prioritize and appropriately engage in-market shoppers.

2. Identify high and low performing sales trends

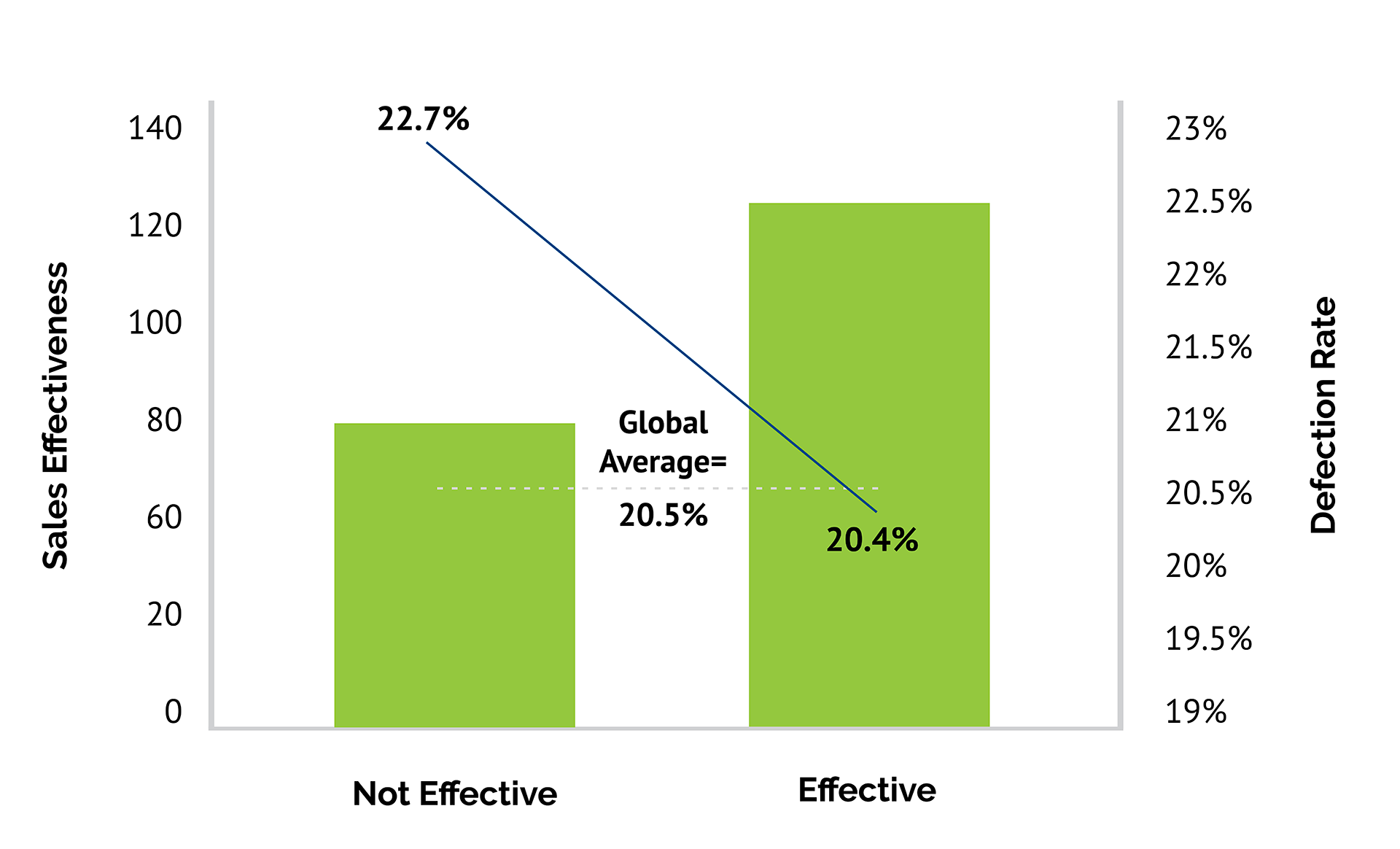

Understanding your dealership’s sales effectiveness — how well you perform against expected sales benchmarks — is a critical first step in identifying performance gaps. Expectations are based on local segment preferences and benchmarked against regional, state and national averages. For example, if a dealer is expected to sell 2,000 units but sells only 1,000, their sales effectiveness is 50%. High defection rates — when leads buy elsewhere — can indicate missed opportunities and often correlate with lower performance.

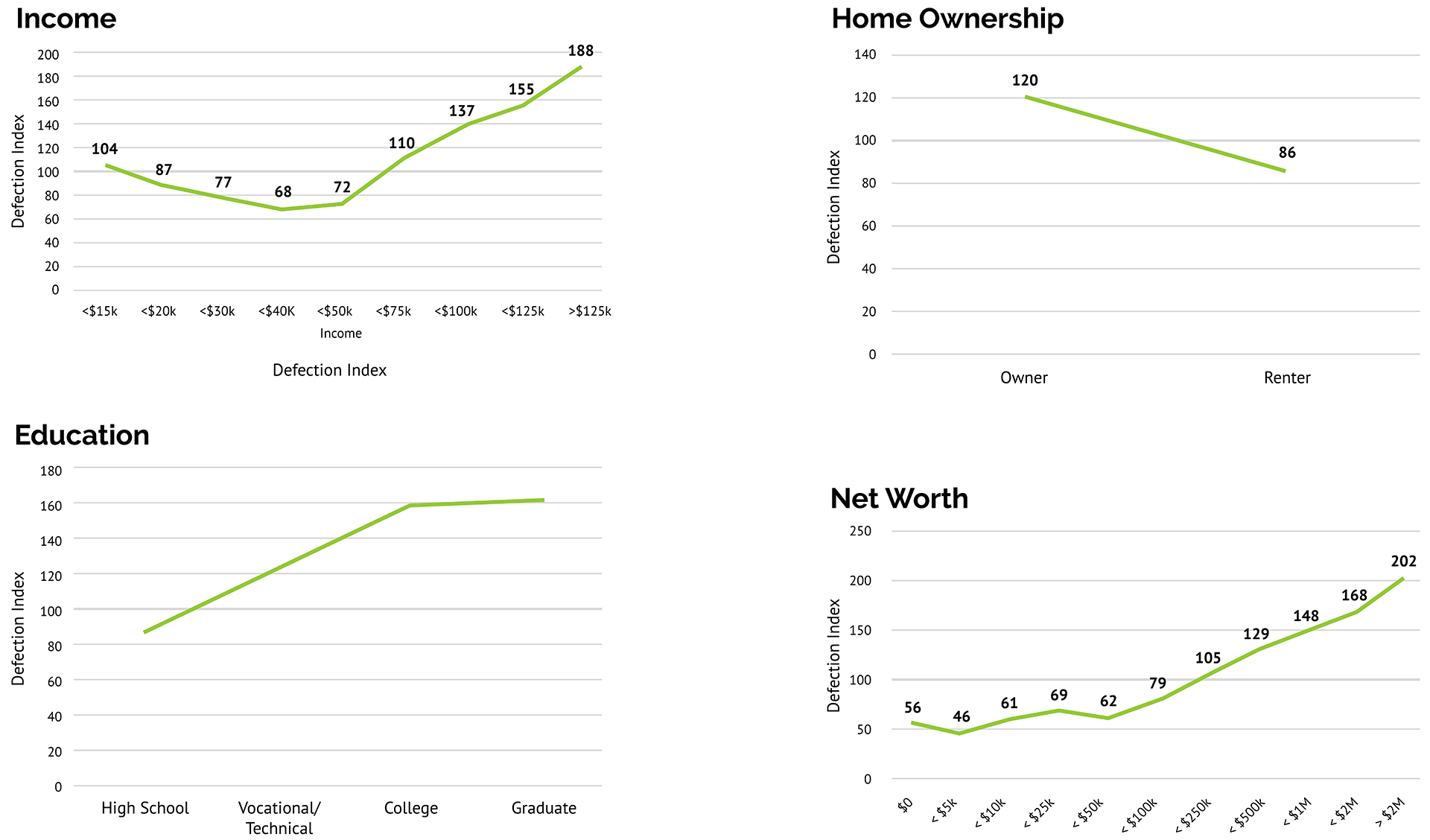

Analyzing lost sales is just as important as studying successful ones. By identifying patterns in why deals fall through — whether it’s location, available models or customer experience — dealers can refine their sales strategies based on data, not speculation. For example, analyzing defection and close rate data can reveal if a salesperson struggles with specific lead types, enabling managers to reassign leads based on individual strengths and improve overall team performance. You can also uncover the models and trims frequently lost to other dealers, empowering you to adjust your mix and proactively stock high-demand units to reduce defections. Our data shows that the most profitable shoppers tend to defect the most, so defection patterns deserve close attention.

The Most Profitable Shoppers Defect the Most

To maximize your close rates, analyze which lead sources are most likely to result in a sale and which are prone to defection (purchasing elsewhere). This enables you to reallocate your marketing spend to the lead sources that consistently produce high-quality leads and allows you to assign certain types of leads to the salespeople who are best at closing them.

3. Optimize your lead follow-up timing and strategy

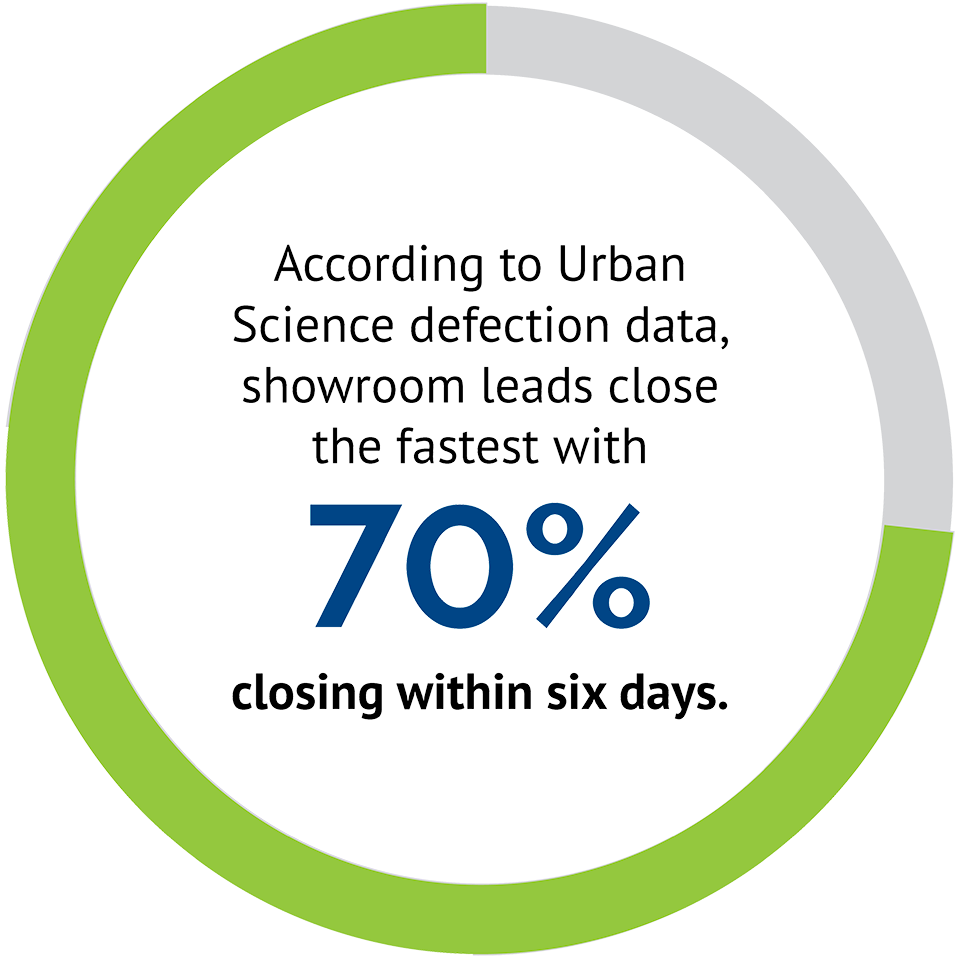

Even the best leads can be lost if follow-up is poorly timed or lacks personalization. Over eight in 10 dealers* say leads are more important than five years ago. According to Urban Science defection data, showroom leads close the fastest with 70% closing within six days. Phone and internet leads are next in line with 70% closing in 11 days, respectively.

This data underscores the importance of timely and tailored follow-up strategies. Sales teams that prioritize showroom leads within the first few days can maximize conversions, while structured follow-up processes for phone and internet leads ensure no opportunity is missed.

Defection data plays a crucial role in empowering your sales team by giving them confidence that a lead is still actively in-market. When salespeople know they’re engaging with prospects who are genuinely shopping, they approach conversations with more energy and purpose. This clarity not only boosts morale but also sharpens focus, helping them prioritize their time and efforts where it matters most.

Fifteen percent of dealers in the U.S. are using defection data to improve their sales processes, tailor marketing strategies and train salespeople. By implementing CRM and overall data hygiene best practices, analyzing lost sales and optimizing lead follow-up timing, you can improve conversion rates and drive sales efficiency.

Urban Science is the only company that offers next-day same and competitive sales and defection data at the individual lead level. With access to over 95% of all new vehicle sales and 99.8% of certified pre-owned sales in the U.S., we provide dealers with the most complete view of the automotive market. Our Dealership Performance solutions are designed to enhance your sales effectiveness, boost profitability and drive better results. Click here to learn more.

*This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,026 U.S. adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (between January 10 to February 4, 2025) and among 254 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager or Principal/VP/Owner (between January 9 to January 30, 2025.) For details about survey methodology, contact arbowering@urbanscience.com.