In the electric vehicle (EV) ecosystem, public charging represents one of the most consistent points of contact between consumers and automakers. Every experience at a charge point, whether positive or negative, influences how buyers perceive a brand. When a charger is broken, lines are too long or a location is hard to reach, that frustration doesn’t stop at the charging station. It bleeds into how consumers think and feel about the vehicle and the automaker, weakening trust and lowering the chance of a repeat purchase. Over time, these issues can even erode confidence in the EV category as a whole.

Buyer Confidence Hinges on Public Charging

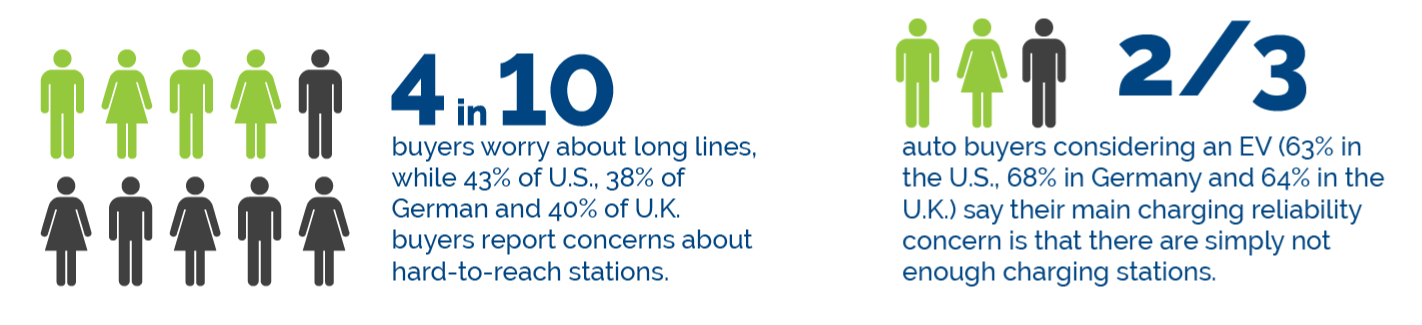

Data from the 2025 Urban Science Harris Poll Study demonstrates just how deeply charging concerns weigh on buyers’ decisions. About two-thirds of auto buyers considering an EV (63% in the U.S., 68% in Germany and 64% in the U.K.) say their main charging reliability concern is that there are simply not enough charging stations. Around four in 10 buyers (39% in the U.S. and U.K., and 42% in Germany) worry about long lines, while 43% of U.S., 38% of German and 40% of U.K. buyers report concerns about hard-to-reach stations.

While the EV industry often focuses on at-home charging, in the U.S., approximately 37% of households are expected to depend on public charging. Renters, residents of multifamily dwellings and owners of older homes may not be able to install private chargers for a variety of reasons, which means they’ll need reliable public charging to make an EV purchase possible. Yet, confidence in the charging network is low. Only 20% of U.S. auto buyers believe the current infrastructure will meet demand over the next three years.

With the majority of buyers concerned about public charging and a large portion projected to be reliant on it, charging infrastructure is poised to become a make-or-break factor in EV adoption.

Mapping the Market Through Charging Access

Because charging infrastructure is directly tied to EV sales growth and brand loyalty, original equipment manufacturers (OEMs) need to track how their sales align with access to – and convenience of – public charging. That requires a close look at each individual market: where stations are located, how far consumers must travel to reach them and where gaps exist.

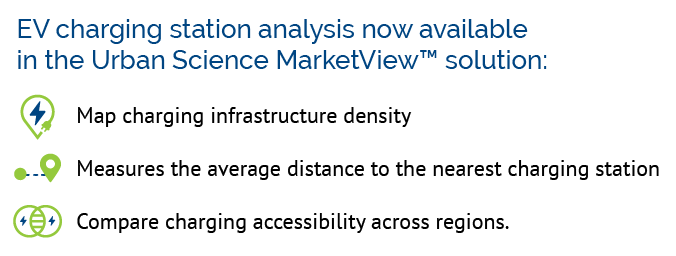

To help automakers understand the correlation between charging infrastructure and EV sales, Urban Science recently added EV charging station analysis to its MarketView™ solution. This new tool maps charging infrastructure density, measures the average distance to the nearest charging station and compares charging accessibility across regions. Armed with these insights, automakers can make smarter decisions about where to invest, turning public charging data into a roadmap for market growth.

Using Charging Station Data to Unlock Opportunity

Linking charging infrastructure with sales performance gives automakers new ways to compete and win in the EV space. In markets where internal combustion engine (ICE) vehicle sales still dominate, infrastructure analysis can reveal whether slow EV sales stem from limited charging access rather than low demand. With that insight, OEMs can focus marketing, incentives and dealer training in the regions with the most potential for broader EV adoption. This would also create a stronger basis for collaboration with local governments or charging providers to expand access in underserved areas.

Beyond correlating lags in adoption with gaps in charging infrastructure, the data enables more nuanced competitive benchmarking. By comparing EV sales performance with competitors in key markets and layering in charging availability, automakers can see where rivals are gaining traction simply because charging infrastructure is more robust. These insights can guide product and network planning, helping OEMs prioritize high-growth EV segments and models.

By homing in on EV sales hotspots, automakers can also identify areas where EV demand may be outpacing infrastructure density or dealer readiness, allowing them to pinpoint where additional investment in public charging or dealer training is needed.

Aligning EV Sales With Charging Infrastructure

The U.S. EV market is harder to forecast than the European market, where government incentives and mandates mean the adoption curve is reasonably predictable. In the U.S., shifting policies, uncertainty around incentives and the introduction of new tariffs are complicating the outlook. That makes reliable sales and infrastructure data all the more important. Tools like MarketView’s new EV charging station analysis, paired with Urban Science’s unrivaled daily industry sales data, give automakers the ability to track developments in real time and adapt with confidence.

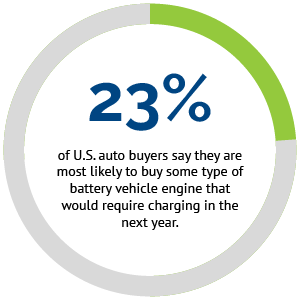

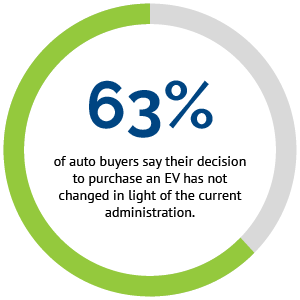

For now, the data suggests demand is holding firm. In the U.S., 23% of auto buyers say they are most likely to buy some type of battery vehicle engine that would require charging in the next year. Meanwhile, 63% of auto buyers say their decision to purchase an EV has not changed in light of the current administration, and 15% indicate they are even more likely to purchase one now. Consumer interest is resilient. But concerns around public charging remain a major barrier automakers must overcome.

The OEMs that overlook the importance of public charging today risk missing out on tomorrow’s buyers. On the other hand, those that build their EV strategies around charging realities can win over hesitant customers and keep them loyal, creating the foundation for long-term brand equity.

*This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,026 U.S., 1,008 Germany and 1,010 UK adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 254 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager or Principal/VP/Owner.

The auto-buying public surveys were conducted from January 10 to February 4, 2025. Data are weighted where necessary by demographics to bring them in line with their actual proportions in the population. The dealer survey was conducted from January 9 to January 30, 2025. Data were weighted as needed based on the average of current and previous waves for gender, car types sold, job title and urbanicity.

The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ±2.2 percentage points for U.S. auto-buyers, ±3.8 for Germany auto-buyers, ±3.5 for UK auto-buyers and ±7.1 for U.S. OEM automotive dealers using a 95% confidence level.