-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- RESOURCES

- NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

June 27th, 2025

How to Turn Your Service Drive

into a Smart Revenue Engine

The service department isn’t a place for oil changes and repairs. At many dealerships, it’s an untapped pipeline to additional vehicle sales and a strategic touchpoint for long-term customer engagement that drives retention and profitability long beyond a service visit. As vehicle ownership cycles lengthen and customer loyalty becomes harder to maintain, the service bay is emerging as the new front line of automotive sales.

With the right tools, every service visit can become a data-rich interaction that reveals a customer’s habits, preferences and potential buying signals. By leveraging the right data and proactive engagement, dealerships can not only boost service revenue but also enhance customer loyalty and lifetime value. In this article, we’ll explore how to make that transformation a reality — step by step.

From reactive to proactive engagement

For years, the service drive was built around a reactive model: Customers brought in their vehicles when something broke and service teams focused on fixing the issue as quickly as possible. It was a necessary function, but not a strategic one. That’s no longer the case.

Today, the most successful service departments are shifting toward proactive engagement. Instead of waiting for problems, they’re using historical industry sales data to anticipate customer needs — whether it’s a routine maintenance reminder or a personalized service offer. In addition, forward-thinking aftersales and sales leaders are using daily industry sales data to guide their marketing and retention strategies. This evolution is transforming the service drive into a revenue engine where every interaction is an opportunity to capture a future sale while building trust and delivering value, without disrupting the ownership experience.

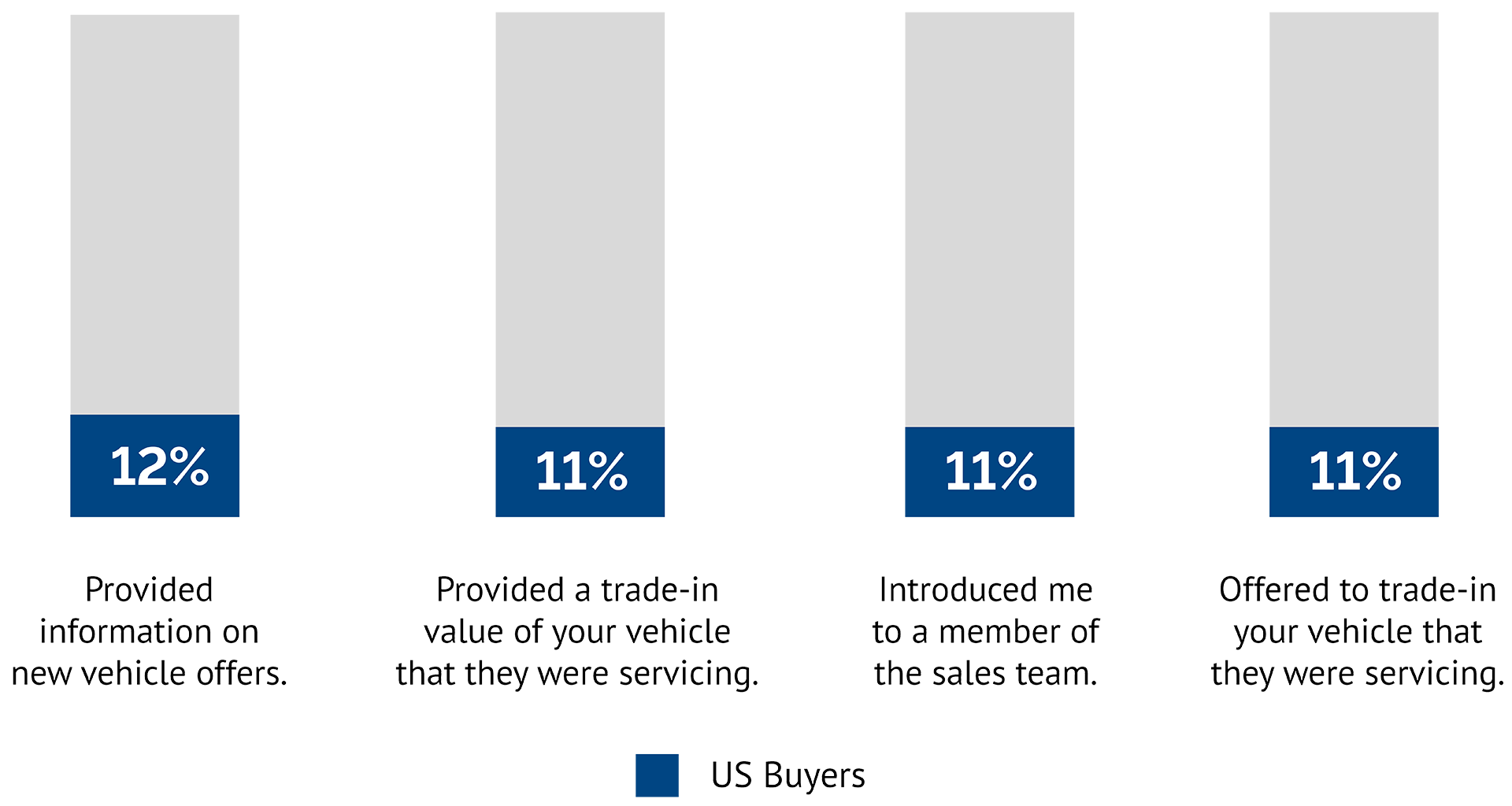

Yet, opportunity remains largely untapped: According to our recent survey*, only about one in 10 auto buyers receive information on new vehicle offers during a service visit. That’s a major missed opportunity — especially when service-loyal customers are more than twice as likely to buy from the dealer where they service their vehicle, according to Urban Science.

Key sales opportunities missed during service visits.

Reframing lost customers and winning them back

Given this connection between service loyalty and sales, losing a loyal service customer to another dealership results in more than a missed transaction. It gives competitors the chance to build a long-term relationship that can lead to future revenue.

Dealers can use science-driven service-to-sales analysis (S2S) to aggregate defection (lost sales) trends by brand, helping service staff engage at-risk groups before they switch brands or dealerships. This includes maintaining a depth of knowledge of same and competitive brand vehicles and offering trade-in estimates and new vehicle options that fit potential buyers’ needs and lifestyle during their service visit. Vehicle age and mileage, service frequency and cost of repairs, and overall vehicle ownership are all signs that a service customer may be ready for a new vehicle.

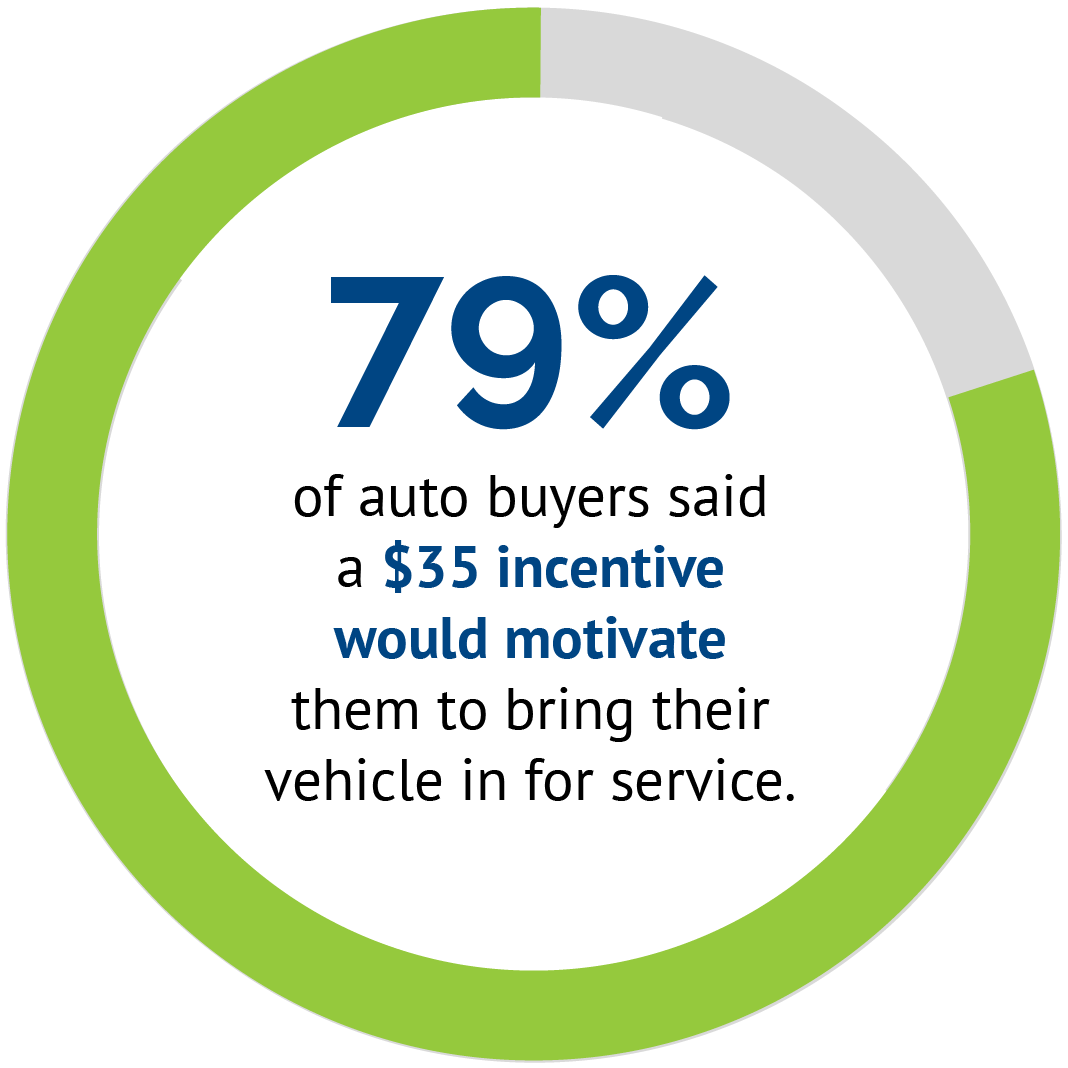

Additionally, dealers can continue to deliver service offers to bring lost customers back into the service lane to reignite the customer relationship. And incentives work. 79% of auto buyers said a $35 incentive would motivate them to bring their vehicle in for service.

Use bonus management to align service and sales

The service-to-sales opportunity remains largely untapped — not because the value isn’t clear, but because the structure isn’t aligned. Service and sales leaders often operate in silos, each focused on their own revenue goals, with little incentive to collaborate.

One of the most effective ways to break down these barriers is through bonus alignment. When dealerships structure incentives to reward shared outcomes — like converting service visits into vehicle repurchases — they create a powerful reason for collaboration. Service advisors become more proactive in identifying potential leads, while sales teams are equipped to follow up with timely, personalized offers.

Yet, only 33% of dealers strongly agree their dealership has processes in place to seamlessly transfer new vehicle sales opportunities from services lanes to the sales floor. That’s a gap and a growth opportunity.

The service drive holds far more potential than many dealerships realize — not just as a maintenance hub, but a powerful engine for revenue, retention and relationship-building. By shifting from reactive to proactive engagement, sharing data across departments (including defections) and aligning incentives, dealers can unlock smarter, more timely sales opportunities right from the service lane.

If you would like to talk to someone at Urban Science about how we can leverage the power of science to create a robust service strategy that helps dealerships better close the loop on new-vehicle sales, call or email me.

Piermichele Robazza

Global practice director, Aftersales

Urban Science, Inc.

pmrobazza@urbanscience.com

248.231.1218

*This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,026 U.S. adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (between January 10 to February 4, 2025) and among 254 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner (between January 9 to January 30, 2025.)