Service has consistently played a pivotal role in driving revenue and profitability at healthy automotive retail outlets across Europe and for leading automakers around the world. In manufacturing, margins for aftermarket services are typically at least double those for new unit sales and can be as much as 10 times higher. Service revenue underwrites other, less lucrative areas of the automotive ecosystem. Without it, many retailer operations would struggle to remain profitable.

The shift toward battery electric vehicles (BEVs) has brought this dependency into sharp relief. New BEV registrations in Europe were up 34% in the first half of 2025 compared to the same period the year before. On the one hand, this is good news for automakers, as many are directing significant resources toward achieving carbon neutrality goals. However, it also underscores a long-standing challenge: BEVs require less maintenance than internal combustion engine (ICE) vehicles. Less maintenance means fewer high-margin aftersales opportunities, which puts traditional revenue models at risk.

The shift toward battery electric vehicles (BEVs) has brought this dependency into sharp relief. New BEV registrations in Europe were up 34% in the first half of 2025 compared to the same period the year before. On the one hand, this is good news for automakers, as many are directing significant resources toward achieving carbon neutrality goals. However, it also underscores a long-standing challenge: BEVs require less maintenance than internal combustion engine (ICE) vehicles. Less maintenance means fewer high-margin aftersales opportunities, which puts traditional revenue models at risk.

Meanwhile, new entrants are steadily expanding their market share. In July 2025, sales of BYD electric vehicles (EVs) rose fivefold in Germany and more than fourfold in the U.K. Tesla, in contrast, saw its July registrations fall almost 60% in the U.K. and over 55% in Germany. Established automakers now face a double threat: declining margins and rising competition.

Where Service and Sales Intersect

The potential of aftersales extends beyond selling parts and labour. Service also supports vehicle sales. Analysis from Urban Science has found service-loyal customers are more than twice as likely to purchase from the retail outlet where they service their vehicle, indicating that loyalty is built in the service lane.

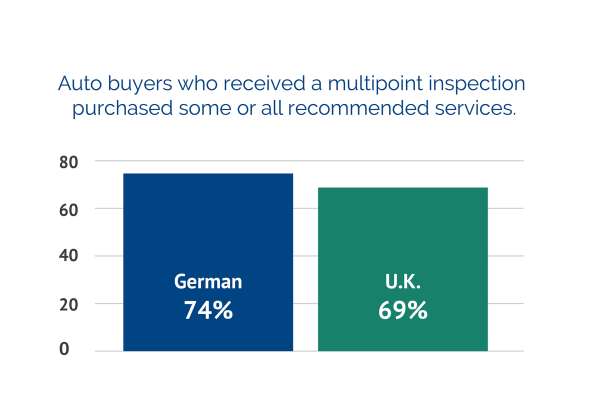

Yet, manufacturers and retailers rarely capture the full benefit. The 2025 Urban Science Harris Poll Study surveyed auto buyers in the U.S., the U.K. and Germany to gain insight into their service experiences. When asked if they received an electronic vehicle health check during their last visit to the dealership, only 34% of German auto buyers indicated that they had. In the U.K., the number was even lower at 25%. This is a significant missed opportunity. Among those who did receive a multipoint inspection, 74% of German auto buyers and 69% of U.K. auto buyers purchased some or all of the recommended services. The implication is clear: service inspections are both an important customer experience touchpoint and a revenue driver. By failing to provide them consistently, retailers are limiting their own upside.

Protecting Service Revenue in a Shifting Market

With competition growing and margins tightening, service revenue is more crucial than ever for original equipment manufacturers (OEMs) and retailers. New entrants are adding to that pressure. That said, established players have advantages newcomers will struggle to match. They have solid service networks, loyal customers and strong brand equity, not to mention decades of operational expertise. New entrants, by contrast, have the benefit of building their service networks from scratch without the burden of needing to maintain and evolve legacy systems, which can be costly, complex and slow to modernize. To protect and grow their service revenue, both categories of automakers should leverage their inherent advantages to build efficient and customer-centric service networks.

Firstly, OEMs and retailers need to double down on their ability to deliver an outstanding customer experience. That means consistency in inspections and clear, regular communication on recommended service and maintenance. Follow-through reinforces trust, inspections lead to part sales and reliable service builds loyalty. When customers return for service, it generates long-term revenue from parts and maintenance and increases the likelihood of repeat vehicle purchases.

Connectivity is another potential lever for profitability. Vehicle data can guide maintenance reminders, enable predictive service and help keep customers within the retail network. In Europe, regulatory challenges make OEM and retailer access to telematics data more complex than in the U.S., but customers are more likely to grant access if the automaker’s service experience earns their confidence. Without that trust, independent repairers and newcomer brands are more likely to capture the opportunity.

Lastly, effective capacity planning is critical. Automakers need service networks that are capable of meeting demand for all vehicle types, allowing them to capture revenue that might otherwise be lost and reinforce long-term loyalty. As BEV adoption grows and internal combustion engine (ICE) vehicle sales decline, the mix of service needs will change. OEMs must ensure they have the right technicians, tools and parts for the vehicles coming through their service bays. Data-driven capacity planning allows automakers to anticipate shifts in powertrain mix and service demand, rather than waiting until they feel the impact in the service lane.

Data As the Differentiator

From improving service interactions to aligning infrastructure with service demand, every viable strategy for service optimization relies on data. To keep existing customers engaged, capture new opportunities and maintain profitability in a shifting landscape, OEMs first need visibility into customer retention, service performance and parts sales. Tools such as Urban Science’s ServiceView™ solution enable leading global manufacturers and retailer networks to track and analyze these factors. This visibility is what allows them to identify inefficiencies, drive revenue growth and close the service-to-sales loop.

The European automotive market is changing quickly. BEV adoption continues to rise, and new entrants are competing more aggressively. At the same time, regional tariffs and trade deals are disrupting supply chains and pushing up costs. In this context, having clear insight into service network performance is crucial. If OEMs do not measure service performance, they cannot effectively manage it. And if they can’t manage it, they can’t optimize it to support critical business and revenue strategies.

In a challenging marketplace, automakers that deliver a superior service experience, capture the revenue tied to inspections and parts and use data to elevate their aftersales operations will be better positioned to compete. As costs and competitive pressure mount, the extent to which established OEMs succeed in optimizing their service networks will determine whether they hold their market share or watch it slip away.

*This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,026 U.S., 1,008 Germany and 1,010 UK adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 254 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager or Principal/VP/Owner.

The auto-buying public surveys were conducted from January 10 to February 4, 2025. Data are weighted where necessary by demographics to bring them in line with their actual proportions in the population. The dealer survey was conducted from January 9 to January 30, 2025. Data were weighted as needed based on the average of current and previous waves for gender, car types sold, job title and urbanicity.

The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ±2.2 percentage points for U.S. auto-buyers, ±3.8 for Germany auto-buyers, ±3.5 for UK auto-buyers and ±7.1 for U.S. OEM automotive dealers using a 95% confidence level.