For those working across the automotive media spectrum, it can feel like advertising is becoming more complex by the day. There are more media channels to manage, more competition for budget, and more data to interpret and act on.

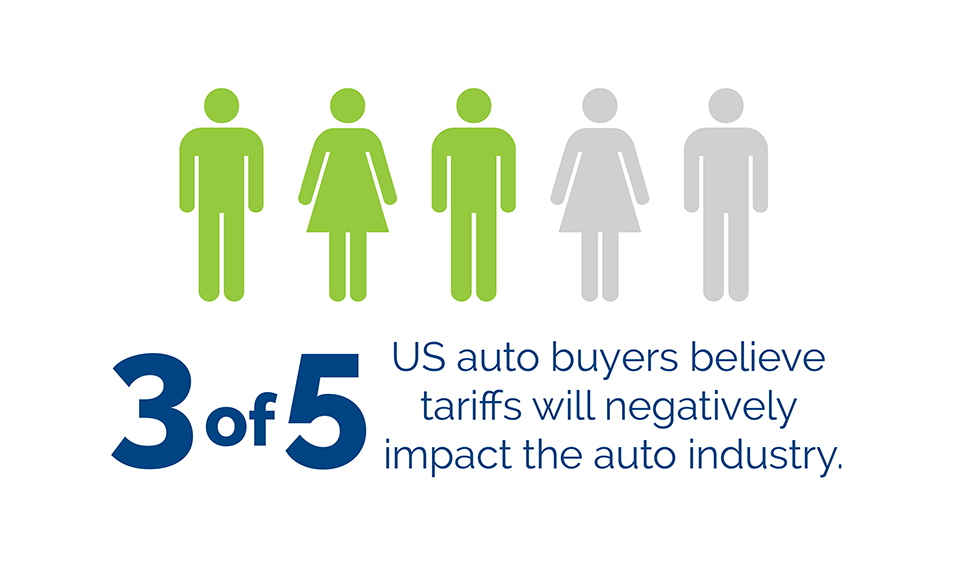

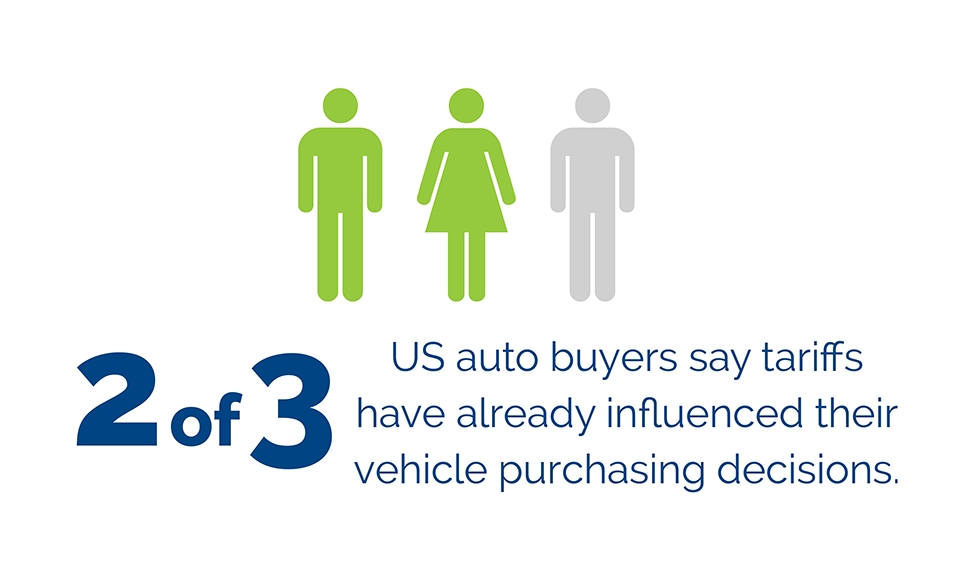

At the same time, external stressors are mounting. Concerns around automotive tariffs and pricing uncertainty are prompting consumers to rethink how (and when) they buy. According to key findings from the 2025 Urban Science Harris Poll Study, 3 in 5 U.S. auto buyers believe tariffs will negatively impact the industry, and two-thirds say tariffs have already influenced their vehicle purchasing decisions.

Uncertain economic conditions often mean leaner budgets, putting advertisers under pressure to stretch every dollar. Now more than ever, marketers need to find practical ways to cut through complexity, simplify execution and improve efficiency. Fortunately, new technologies are emerging to make that possible. Automation can reduce manual work, while new data integrations can enable advertisers to leverage AI-powered optimization to drive more efficient spend based on actual outcomes.

The key to deploying both tools effectively? Relevant, timely industry sales data — updated daily.

Optimizing For Outcome-Based Metrics

The majority of automotive brands optimize their marketing campaigns to achieve website key performance indicators (KPIs), such as clicks and site visits, without fully taking sales outcomes into account. While these upper-funnel metrics are easy to track, they don’t always correlate with sales, nor do they tell the whole story. As a result, advertisers can end up optimizing campaigns for activity rather than business impact. A more effective approach is to build measurement strategies that balance upper-funnel signals with outcomes tied to sales. In the automotive retail space, vehicle sales may not always be the top metric, but they should always be included as part of a holistic measurement strategy.

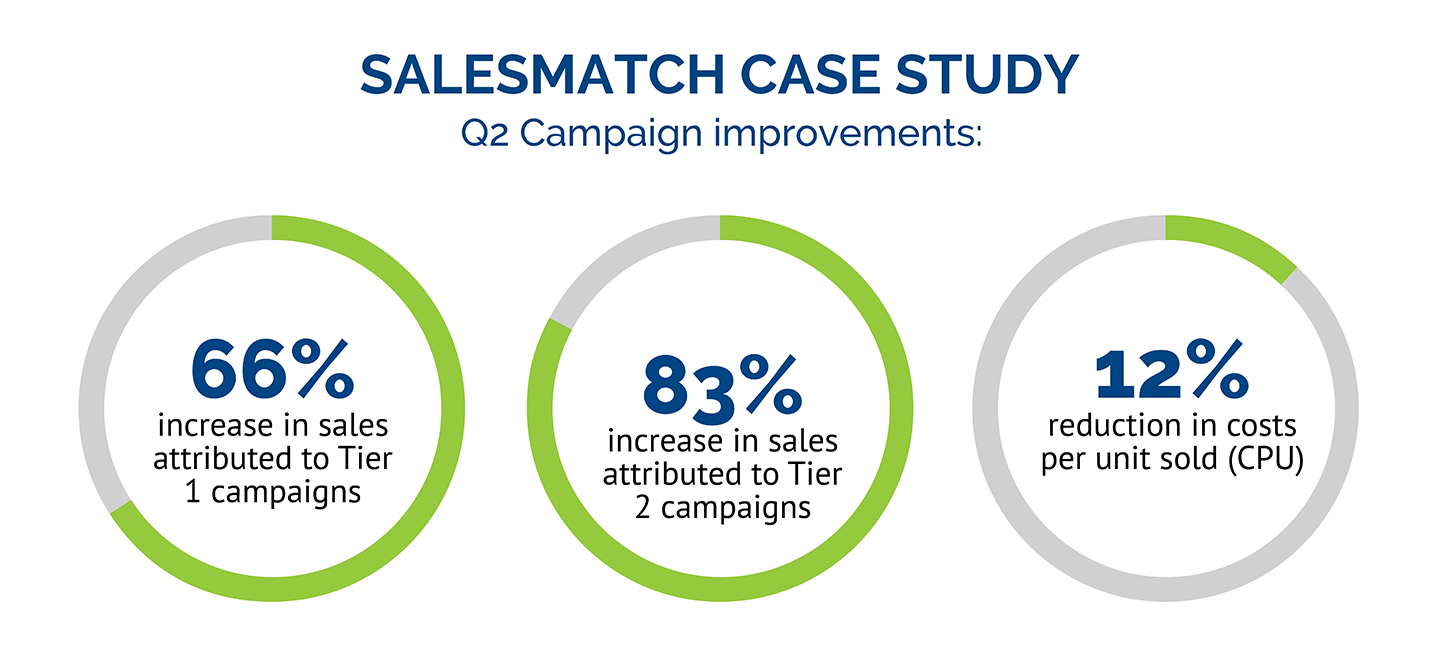

Urban Science recently worked with an agency client to analyze the effect of auto-optimization on its advertising campaigns for a leading global automaker. In this instance, the agency leveraged Urban Science’s SalesMatch solution, which connects online activities to offline sales, providing precise, sales-based attribution. This empowered the agency to optimize its Q2 campaigns toward actual sales, using AI-enabled auto-optimization features available on its demand-side platform (DSP).

When compared with Q1 campaigns, which were optimized toward site outcomes, the automaker saw a 66% increase in sales attributed to Tier 1 campaigns and an 83% uptick attributed to Tier 2 campaigns, along with a 12% reduction in cost per unit sold (CPU). Even when accounting for the tariff-related demand shifts that characterized Q2, the brand’s attributable sales rose 40% to 80% more than competitive sales, pointing to the optimization strategy as the performance driver.

A Productivity Windfall

Technologies like AI-enabled auto-optimization don’t just boost results. They help automotive marketers achieve operational improvements that drive efficiency and better margins. In the past, agencies and advertising teams had to spend countless hours combing through ad reports, analyzing insights and making manual optimizations to campaigns to improve performance.

Now, automated systems can do much of this analysis and action successfully without human intervention, but only when powered by high-fidelity conversion data that includes both on-brand and competitive signals. With the right performance data, these systems can make ongoing adjustments without the need for constant manual oversight. This is a productivity windfall for marketers. Timely, relevant and accurate data can enable AI to precisely predict consumer behavior by capturing real intent, reducing noise and personalizing media delivery. By reducing the time and resources required for tactical execution, automated processes free up agencies and advertisers to focus on the areas where human input is irreplaceable, particularly for strategy and planning.

Agencies will need to adapt quickly, as this shift is already well underway. Meta reportedly aims to offer a fully automated advertising model that would allow brands to develop, launch and manage campaigns in-platform by the end of next year. Over time, such advancements are likely to free agencies from routine, tactical tasks, enabling them to dedicate more energy to strategic and creative work that elevates their clients’ advertising. However, while AI can simplify processes, it can’t compensate for poor direction. Brands will need to strike a balance: Integrating automation to ease complexity, while ensuring human creativity and critical thinking continue to power their advertising strategies.

Data at the Core

Optimizing for the right metrics can improve results and automating processes can simplify execution. But none of this is possible without solid underlying data. AI and automation are only as strong as the information they learn from; if the inputs are incomplete or of low quality, the outputs will be too.

For features such as auto-optimization to function effectively, they require both timely, relevant and high-quality data with competitive signals and a broad data set. Many platforms, Meta included, possess valuable first-party data assets. Automakers’ own data adds context, but it still only provides part of the picture. To account for the whole market, advertisers need the breadth of daily, industrywide sales data that can inform algorithms and tailor optimizations to the unique dynamics of the automotive sector. Without that breadth and quality of data, even the most advanced AI tools cannot deliver on their promise.

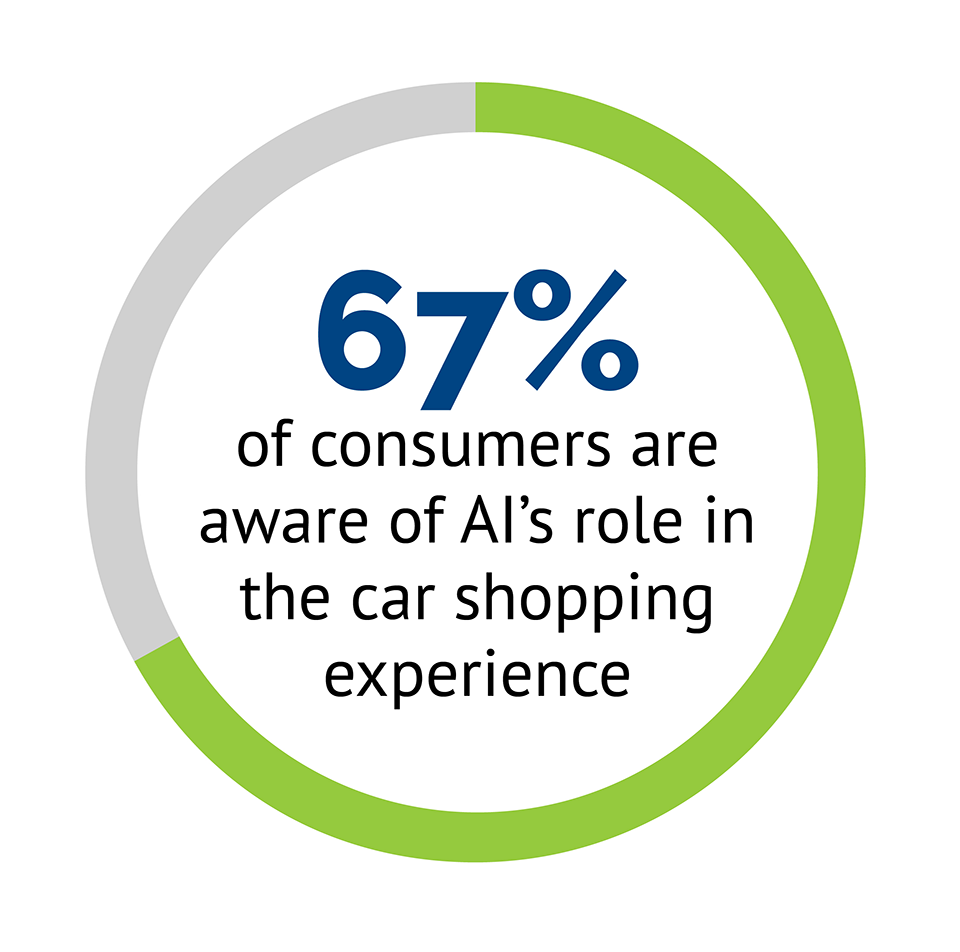

It’s particularly important that marketers leverage AI in ways that deliver tangible value, as consumer skepticism surrounding AI is on the rise. Research shows the majority (67%) of consumers are aware of AI’s role in the car shopping experience. Yet in 2025, auto buyers were less likely to see AI as having a positive impact on steps such as comparative shopping, research and vehicle configuration. When advertisers fail to ground AI in strong, reliable data, the results can feel clumsy or misleading. That risks alienating the very audiences those advertisers most want to reach.

It’s particularly important that marketers leverage AI in ways that deliver tangible value, as consumer skepticism surrounding AI is on the rise. Research shows the majority (67%) of consumers are aware of AI’s role in the car shopping experience. Yet in 2025, auto buyers were less likely to see AI as having a positive impact on steps such as comparative shopping, research and vehicle configuration. When advertisers fail to ground AI in strong, reliable data, the results can feel clumsy or misleading. That risks alienating the very audiences those advertisers most want to reach.

The New Performance Baseline

Simplification often carries the perception of cutting corners or lowering standards. In reality, it’s about concentrating resources on the levers that produce the greatest impact. For automotive advertisers, that means anchoring campaigns in data and orienting them toward the most relevant results. Outcome-based metrics, such as higher vehicle sales and CPU, give marketers a clearer view of the return on their ad dollars. Automation and AI-enabled optimization reduce the time spent on manual adjustments, allowing teams to devote more time and energy to strategy. Most importantly, timely, industrywide sales data provides the engine that powers these tools.

As new channels and technologies emerge, advertisers will need to navigate new complexities. Meta’s push toward full automation provides one example of just how much the industry is likely to change in the near term. The challenge will be finding clarity amid this complexity by zeroing in on the opportunities these new capabilities offer to create measurable results. And those who act fast will stand to benefit the most.

Right now, brands effectively using AI to automate and optimize, powered by the right data, are seeing outsized gains. But it’s only a matter of time before these practices become table stakes.

*This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,026 U.S. adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto buyers” or “auto-buying public”) and 254 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager or Principal/VP/Owner.

The auto-buying public surveys were conducted from January 10 to February 4, 2025. Data are weighted where necessary by demographics to bring them in line with their actual proportions in the population. The dealer survey was conducted January 9 to January 30, 2025. Data were weighted as needed based on the average of current and previous waves for gender, car types sold, job title and urbanicity.

The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ±2.2 percentage points for U.S. auto-buyers and ±7.1 for U.S. OEM automotive dealers using a 95% confidence level.