-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- RESOURCES

- NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

With increasing inventory and strong consumer demand, dealers need to step up to win auto buyers.

This is the fifth in a series of Urban Science articles driven by our 2023 research conducted alongside The Harris Poll. In this article, we’ll explore findings regarding dealership service across the U.S. and share key insights OEMs and dealers should consider to drive profitability and business success across their stores now and down the road.

January 24th, 2024

With inventory back and prices stabilizing, consumers are shopping again – and their expectations are high. They’re shopping more dealerships and being more discerning with their choices. Dealers who hope to convert these shoppers into buyers need to put engaging with auto buyers at the top of their to-do list. This article reveals insights uncovered in a 2023 study by The Harris Poll,1 commissioned by Urban Science, and provides a roadmap to help dealers successfully navigate today’s increasingly challenging selling dynamic.

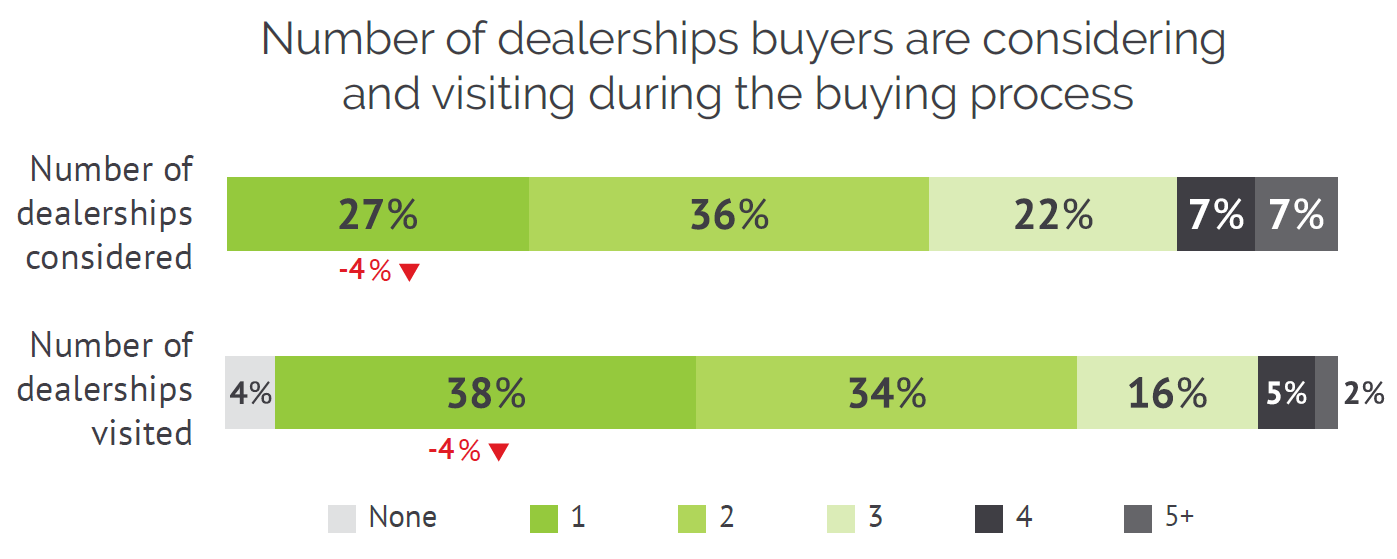

A close observation of consumer shopping patterns over the past three years reveals important insights regarding auto-buyer behavior. While the number of dealerships considered (2.4) and visited (1.9) has remained relatively stable through the pandemic and chip shortage, nearly a quarter of today’s shoppers (23%) are visiting three or more dealerships before making a buying decision.

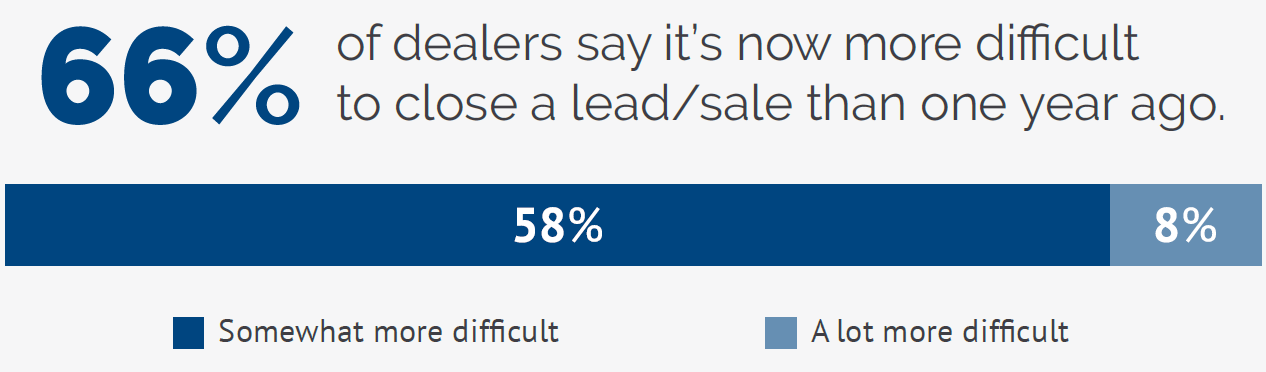

Clearly, the “take it or leave it” quandary auto buyers faced during that time period has given way to a marketplace where dealers need to step up their selling efforts to win over shoppers. The total U.S. supply of unsold vehicles climbed to 2.40 million units. Compared to a year ago, that represents a 62% uptick2 in unsold vehicles on dealership lots and in transit. That not only gives shoppers more choices, but also more leverage – which translates to more pressure on dealerships that, when inventory was low, didn’t have to compete as hard to close a sale.

A more competitive marketplace requires more strategic action.

Compounding the challenge of closing leads is how confident dealers themselves feel about their ability to generate leads (down 10 percentage points YoY).

In such an environment, two key strategies are helping dealers differentiate their offers and gain (and retain) customers:

#1 Protect and grow relationships

#2 Differentiate their brand(s) and motivate consumer action

Strategy #1:

Protect and grow relationships

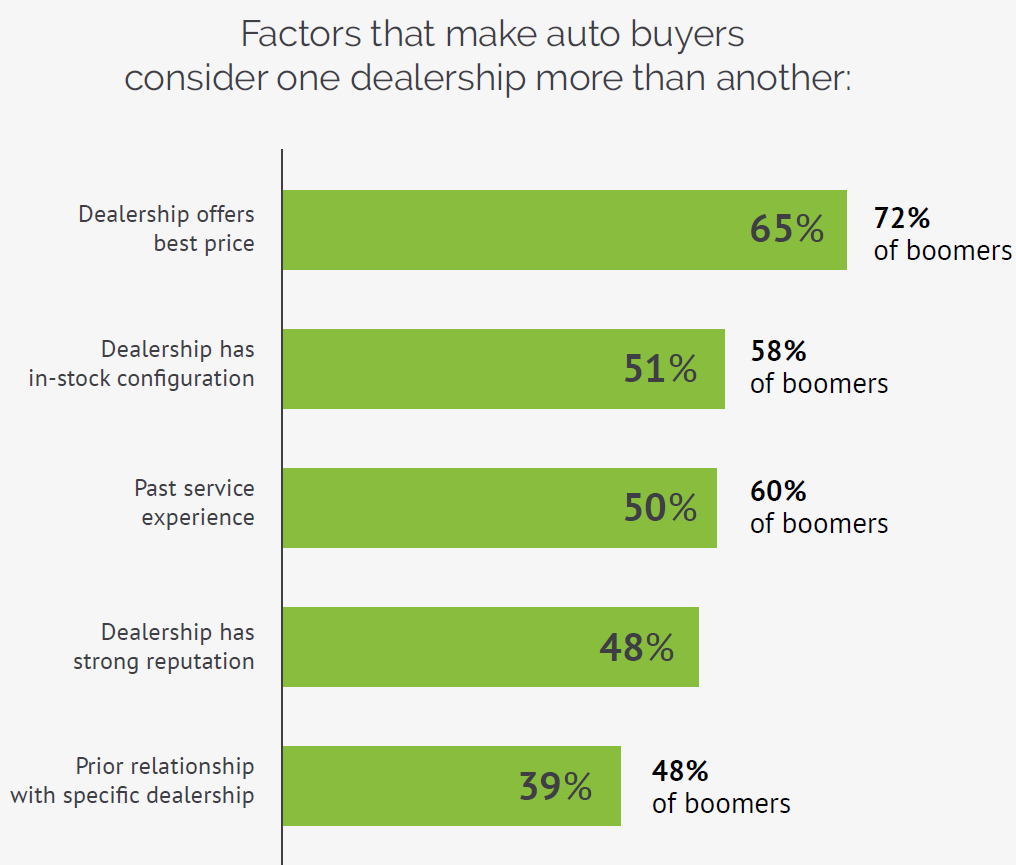

There are a number of other factors at play in today’s increasingly competitive automotive marketplace beyond the obvious: “price” and “inventory.”

When it comes to auto buyers’ criteria for choosing a dealership, our study reveals – beyond the initial factors of price and having the desired vehicle in stock – the next highest-ranking attributes all revolve around relationships. Past relationships with a dealer for both sales and service create a strong foundation for future loyalty. Additionally, a dealer’s reputation via word of mouth, online reviews and ratings is a valuable asset earned through consistent customer satisfaction, ethical business practices and transparent communication.

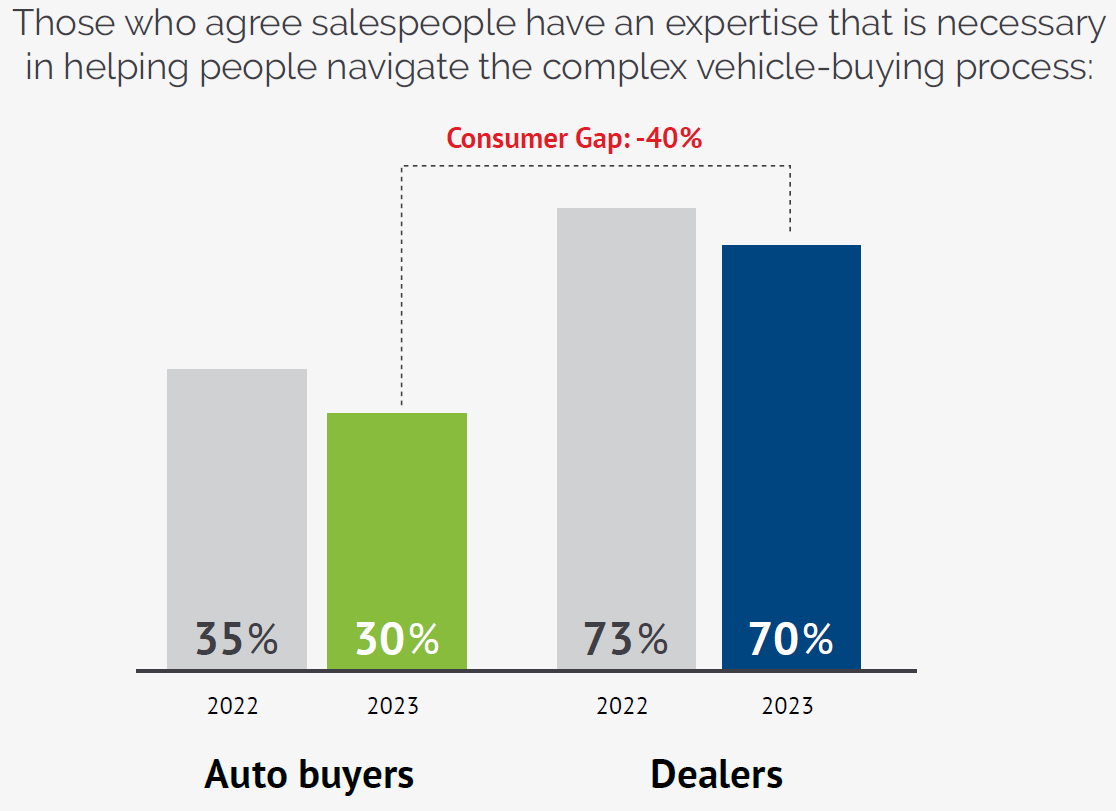

At the same time, shoppers are losing confidence in salespeople. In fact, auto-buyer perception of salesperson expertise has dropped five percentage points in the past year. With the growing complexity of vehicle features and technologies, a knowledgeable salesperson is an essential resource to help auto buyers navigate the process and make confident, informed decisions.

Equally concerning is the significant disparity between how auto buyers perceive salesperson expertise and how dealers assess themselves in this regard. This disconnect raises critical questions about the industry’s approach to customer engagement and underscores the urgent need for a transformative strategy.

The best way to solve the problem is to own it, and work to overcome it. How? With data-infused training. The best training incorporates daily defection data which:

- Empowers your salesforce through near-real-time feedback on what’s working and what’s not

- Allows you to train your salesforce with known lost opportunities identified in near real time

- Allows your salespeople to pivot communications to relevant customer messaging, including service offerings

Training can also surface issues that need correcting and teach techniques to better engage with customers. Training salespeople to understand today’s retail selling dynamics has become the “price of entry” in creating a salesforce that’s knowledgeable and engaging. Weak salespeople can become better and more confident with targeted training, while strong salespeople can become a dealership’s competitive advantage.

Strategy #2:

Differentiate and motivate

Now – more than ever – data can help dealers dive deep into ways to target and motivate auto shoppers – and one way to do that is through incentives. With auto buyers visiting more dealerships and competition ramping up for sales, OEMs and dealers alike are getting back into the incentive game to get potential customers through the doors. While OEMs often use broad brush strokes to build awareness and motivate action through incentives, dealers can be more surgical in their application of incentives to drive action.

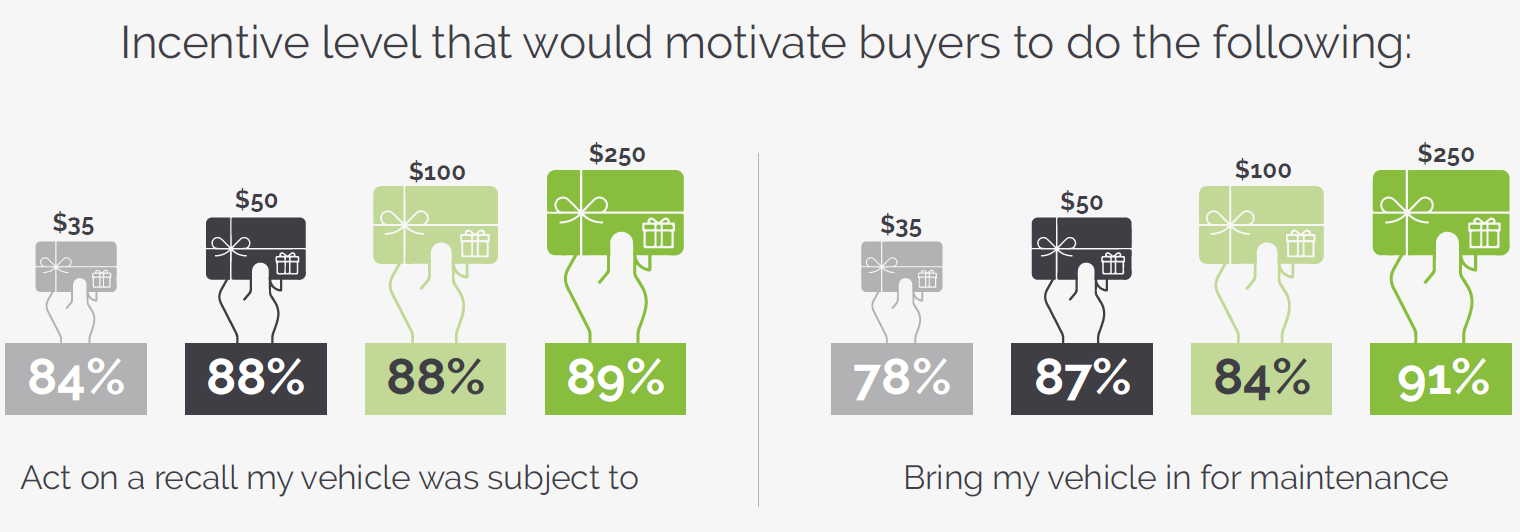

According to our research, auto buyers reported it would take as little as $35 to motivate them to take a test drive (82%), test drive an EV (67%), bring their vehicle in to resolve a recall (84%) and get vehicle maintenance (78%). The delivery of private incentives is proven to move the needle on both sales and service – and even small incentives motivate. In fact, one solution, Urban Science’s AutoHook,3 which empowers dealers to deliver targeted incentives through text, email or website overlay, has been proven to drive an 8.9% new-vehicle sales lift – that’s roughly 7.5 incremental sales over a 60-day period.

In this era of personalized marketing, understanding the nuances of customer preferences and behavior in near real time is pivotal. By harnessing the insights derived from this data, OEMs and dealerships can craft incentives tailored to individual needs, driving meaningful actions and bolstering sales and service revenue. The ability to deliver precisely targeted incentives through near-real-time industry sales data empowers the automotive industry to establish deeper connections with customers, enhance brand loyalty, and ultimately, thrive in an increasingly competitive market.

Science as a solution

The ever-changing, ever-evolving automotive marketplace requires flexibility and an openness to adjusting training, sales processes and marketing to meet the needs of today’s auto buyers. Fortunately, there are professionals with the knowledge, expertise and experience to help.

Since our founding over four decades ago, our proven, scientific approach to automotive retailing has continued to improve and evolve. It’s an approach that stays ahead of the technological curve to help improve marketing, sales and service performance – and continues to be the industry standard – giving you the best opportunity for success in your dealership.

If you’d like to connect with someone at Urban Science about the topics discussed in this article – contact us.

Let us show you how we can help you find, attract and retain more customers. Read next article.

1. This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,022 U.S. adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”) and 250 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager or Principal/VP/Owner. The auto-buying public survey was conducted from January 26 to February 15, 2023. The dealer survey was conducted January 26 to February 17, 2023.

2. “New-Vehicle Inventory Rose through October Despite UAW Strike,”

https://www.coxautoinc.com/market-insights/new-vehicle-inventory-october-2023/

3. “We’ve Turned Motivating In-Market Prospects Into a Methodology,”

https://www.urbanscience.com/autohook/