This article was authored by Brian Pasch and originally published on LinkedIn. It highlights research from the 2025 Urban Science Harris Poll study exploring how tariffs, affordability concerns and evolving EV sentiment are shaping consumer behavior in the automotive space.

Urban Science® Data Reveals Consumer Shopping Mindset Regarding Tariffs & DTC Models

Each year, Urban Science partners with The Harris Poll to publish several studies on consumer and dealer research which should be on the required reading list for all store managers, dealer principals, and OEM leaders. Dealers who are part of 20-Group meetings should also consider inviting the Urban Science Executive Team to present their annual research reports, which are always filled with actionable and insightful data, to group members.

I picked a few slides from two Urban Science research reports which were published recently. The data will surely start conversations between dealers and their sales teams, particularly if they want to invest in new sales strategies and CRM communication templates.

I hope this research initiates a discussion on how to best meet the needs and concerns of today’s auto shopper.

The Tariff Effect on Affordability: What Are Consumers Feeling?

First, let me define the survey dataset.

The Harris on Demand (HOD) survey was conducted online by The Harris Poll on behalf of Urban Science among 2,000 US adults aged 18+, of whom 1,844 currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”). The survey was conducted from May 8 to May 12, 2025.

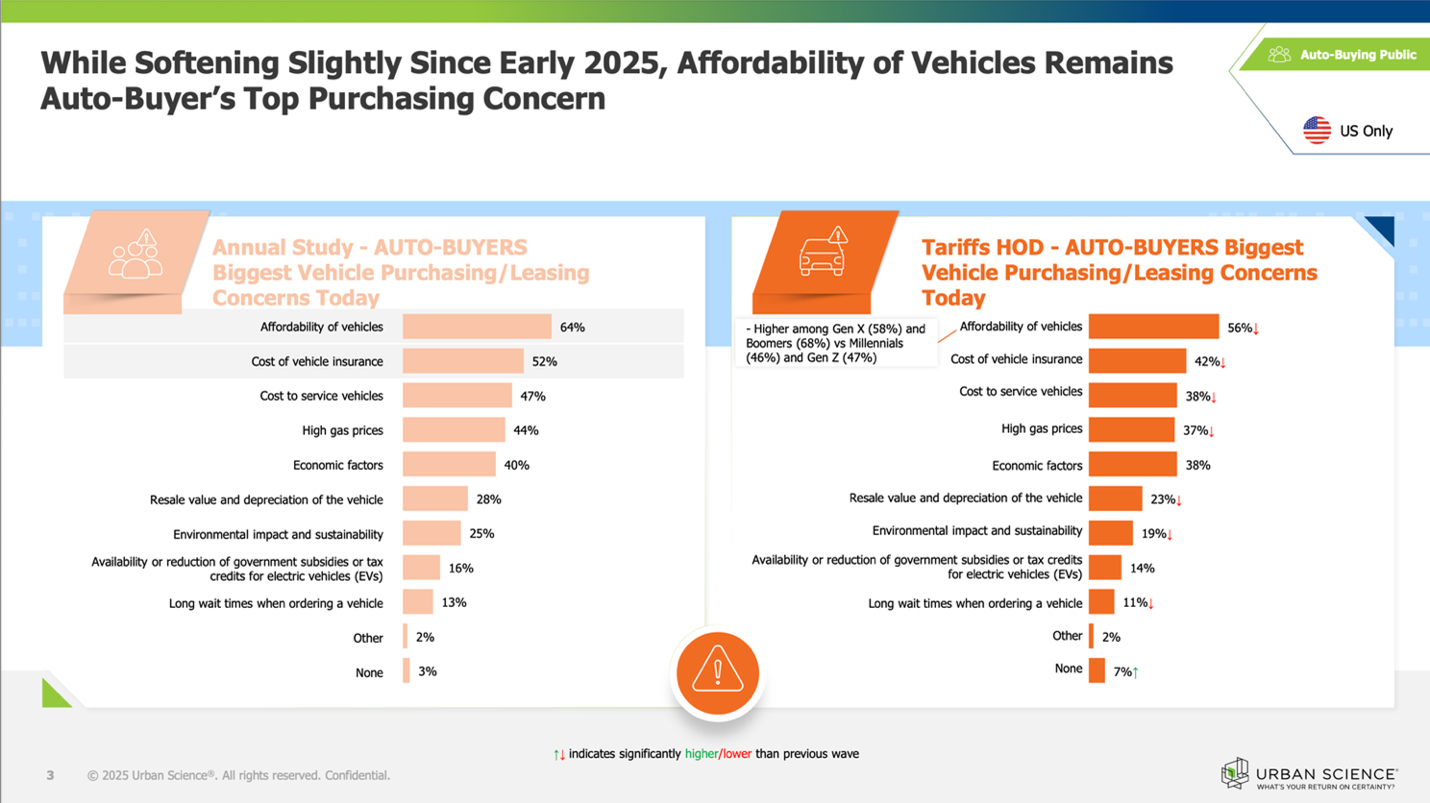

62% of consumers are concerned about tariffs (Illustration 1.0) but, for the most part, the prices of vehicles have not risen in the marketplace. Why are retail prices not rising yet? One answer is OEMs have cut back on rebates and incentives to avoid raising prices. While this might be appealing to the consumer, the franchise dealer network is feeling the impact because the financial leverage is gone.

Dealers are still seeing the impact of COVID pricing, which is causing trades to be so underwater that a new vehicle payment becomes out of reach for some consumers.

The sticker shock which consumers are facing when trading in their existing vehicle is supported by the Urban Science research (Illustration 2.0). When tariff concerns are added to concerns about affordability, my response is to ask dealers what their plans are to educate consumers about solutions.

If dealers continue to promote just price, then they will miss these two primary consumer concerns of the current auto shopper.

Dealers who invest the time to ask questions and properly address the concerns of consumers will win. However, my recent mystery shopping has revealed that most lead response templates are ignoring tariff and affordability messaging.

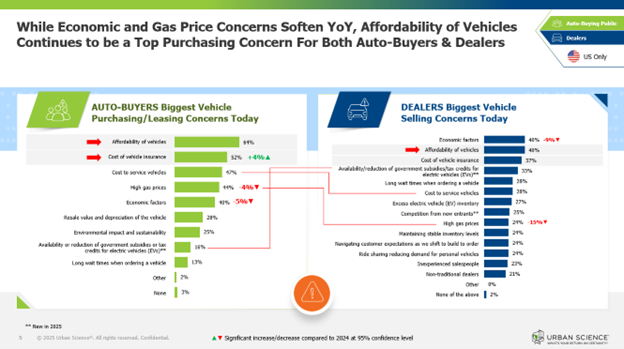

It’s important to note, the discrepancy between automotive consumers and dealers when it comes to purchasing concerns. This data can help you realign with the market to ensure your processes are in lock-step with today’s auto buyer.

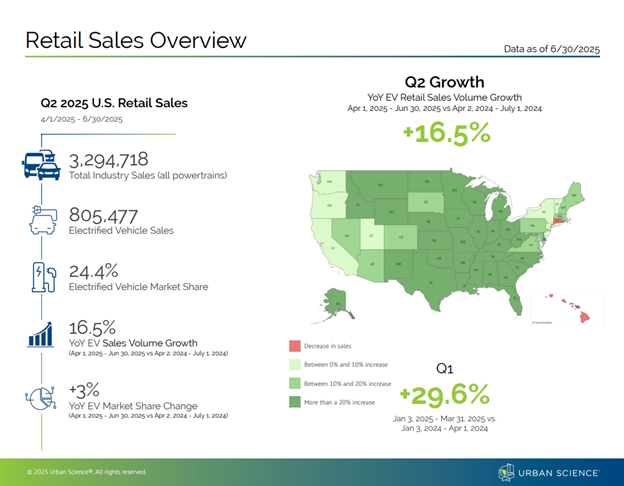

As we know, affordability is a common concern (and has been for years), yet consumers are still purchasing (April 2025 saw a 14% increase in retail sales volume when compared to Apri 2024*). If we take a look at figure 3, we can see that in addition to high vehicle costs, 47% consumers are worried about the added cost of servicing a vehicle, yet, when you look at the dealer side, only 28% believe this is a significant selling concern. This misalignment, is one example where dealers can step up and/or create processes to ease consumers affordability woes. Dealers could offer warranties, free oil changes for the first year after purchase, and other incentives to combat higher vehicle costs.

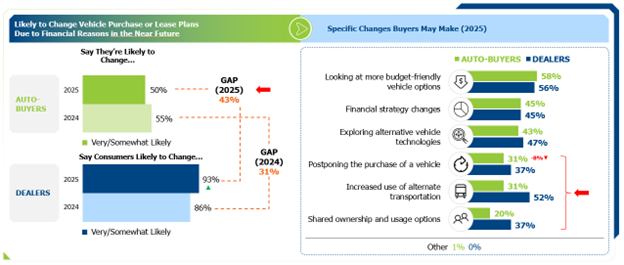

It should also be noted that price disagreements shouldn’t be the “get out of jail free” card if your sales team is losing leads. Even though vehicle affordability is top of mind for consumers, it isn’t stopping them from purchasing. And only half of the consumers who plan to purchase are likely to alter their purchase due to financial reasons (a 5% decrease from 2024) – However, 93% of dealers believe consumers are likely to change their plans.

If we dive into the graph below, we can see, that while some consumers might alter their plan, postponing isn’t high on the list. In fact, consumers want to be shown more budget friendly options – is your team trained and ready to handle consumers questions and show similar alternative vehicle choices when asked?

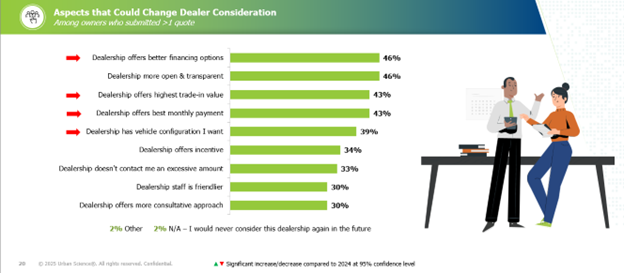

In addition to your team showing consumers budget friendly options, buyers noted the following could lead to them choosing your dealership over another.

– it is imperative that your team is ready to discuss financing options, prepare strong trades, and discuss monthly payment options with consumers.

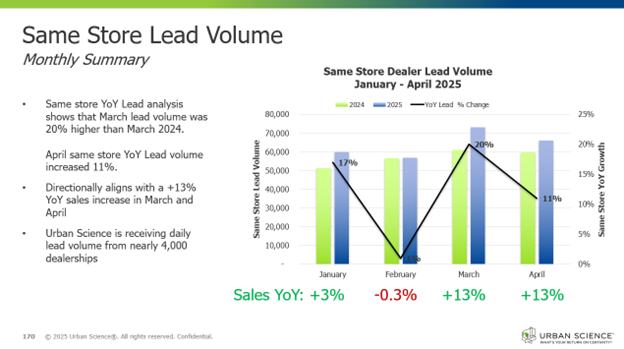

Lastly on the topic of affordability, dealers need to prepare to outcompete their competition. The long and short of it is, consumers are shopping around more to find better pricing, subsequently leading to more leads submitted – meaning, your store needs to be prepared to handle the increase in volume. How can you become more efficient and keep your sales team focused on in-market leads?

*an increase in Q1 sales could be reflective of shoppers pulling ahead purchases due to tariff concerns.

The insights shared above are just scratching the surface. I highly recommend having a conversation with an Urban Science expert to learn more about these reports and how better data can help you optimize your dealer operations. Urban Science’s daily sales data can pinpoint areas for sales person coaching, through their integrations with CRMs and CDPs they can help you identify areas for improvement or holes in your processes and they can eliminate defectors (lost leads) from your sales team follow up (ensuring they are ready to meet the demand that comes with higher lead volume).

Better data = more informed decisions = stronger sales processes = more sales.

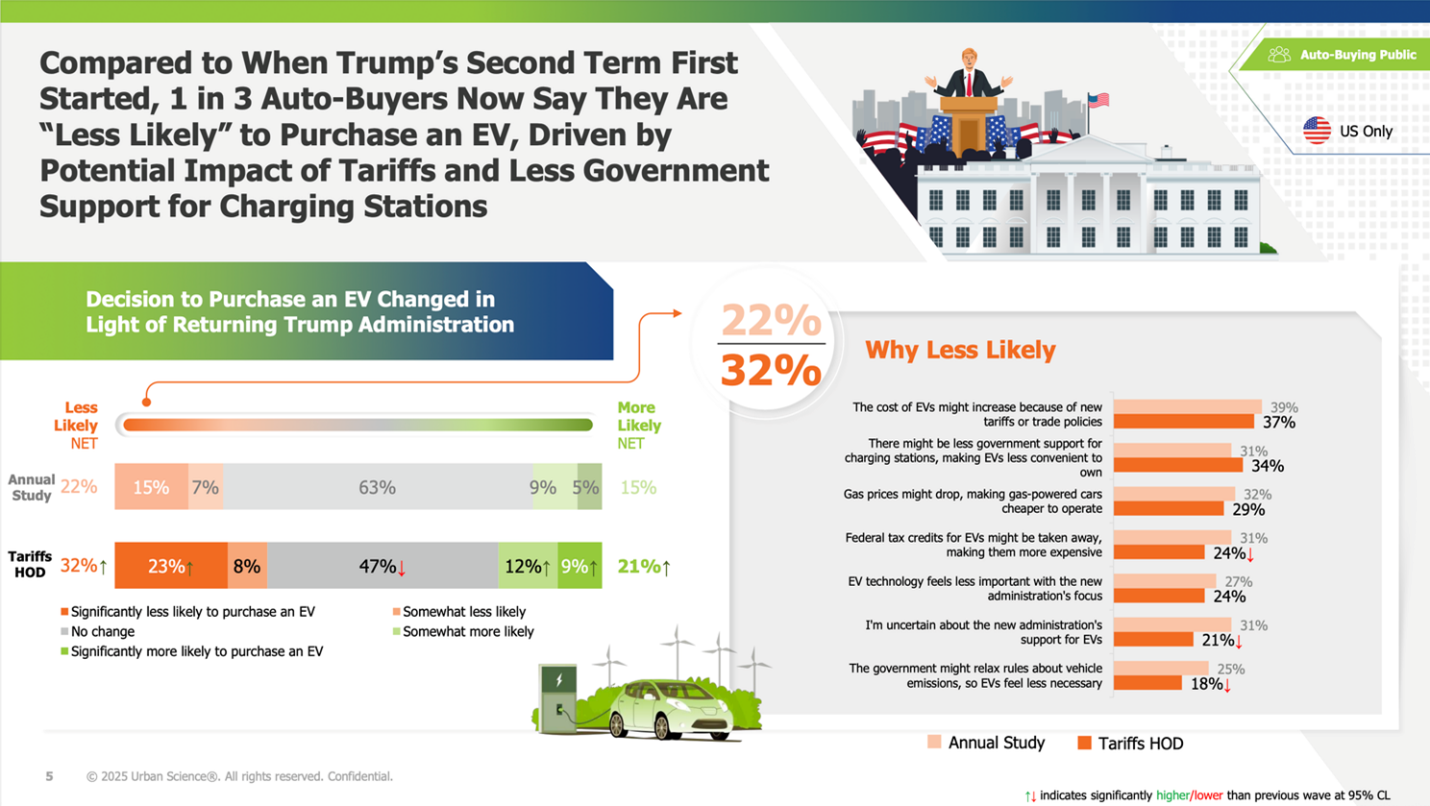

The EV Pushback: New Legislation Was Foreseen

Consumers are less likely to purchase an EV based on a combination of factors. Subsidies for EV purchases look like they are off the table for the current administration. Lower gas prices, higher maintenance costs, and the lack of infrastructure adds to the concerns of consumers who are shopping for the next vehicle.

I’ve also read that consumers who have an EV are reconsidering whether another EV should be their next purchase. Hybrids are looking like the smarter choice for consumers who are more realistic on the potential investments state and federal government will make to expand the power grid and reliable charging stations.

It doesn’t help that the current news cycle is filled with stories of reduced and canceled investments in EV models from the major US OEMs.

When CNBC publishes a story with the title “EV euphoria is dead. Automakers are scaling back or delaying their electric vehicle plans,” you know a major shift has occurred. Dealers with aging inventory of EV models need to act quickly to rebalance their stocking portfolio.

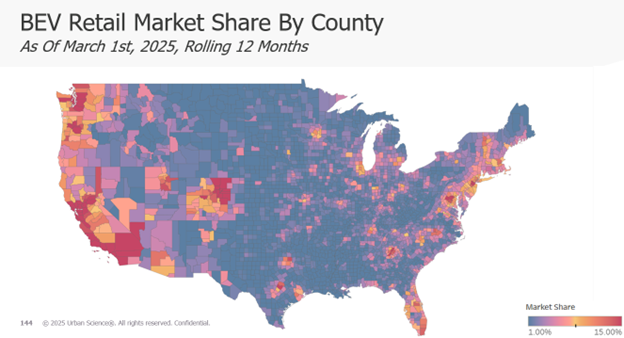

In the meantime, how do you move the EV vehicles on your lot? Urban Science’s pulse on the industry can help you plan for a future and, if you’re a group, help you reallocate EV inventory to geographical areas with the highest purchasing potential via their EV forecasting data. Connect with their expert, Tom Kondrat, to understand the hottest areas of market potential and how to plan ahead, or review their quarterly EV sales report here.

This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,026 US adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 254 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner.

The auto-buying public surveys were conducted from January 10 to February 4, 2025. Data are weighted where necessary by demographics to bring them in line with their actual proportions in the population. The dealer survey was conducted January 9 to January 30, 2025. Data were weighted as needed based on the average of current and previous waves for gender, car types sold, job title, and urbanicity.

The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ±2.2 percentage points for US auto-buyers and ±7.1 for U.S. OEM automotive dealer using a 95% confidence level.

Next Steps

These slides are just a few highlights from the Urban Science / The Harris Poll research. If you would like a copy of these two research reports, or if you would like to speak to Eric DeMont about presenting this data to your 20-Group or at an internal dealer meeting, book a time on his calendar here.