-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- RESOURCES

- NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

August 11th, 2025

Amid affordability concerns, knowing your audience makes all the difference

Against a backdrop of rising interest rates, automotive tariffs and general economic uncertainty, affordability has become an increasingly important factor in automotive retail. In the 2025 Urban Science Harris Poll Study*, 64% of auto buyers said affordability was their top concern when purchasing or leasing a vehicle , making it the leading concern among all auto-buyer considerations.

For original equipment manufacturers (OEMs) and the marketers who support them across the automotive media spectrum, this increased focus on affordability underscores the need for precise, effective and dynamic targeting in advertising campaigns. After all, few can afford to waste money advertising to a consumer who isn’t in the market — or in their market.

Smart segmentation for shifting priorities

When consumers are worried about the economy, they tend to cut back on their spending — and vehicle sales are no exception. That doesn’t necessarily mean auto buyers will drop out of the market entirely. However, it does make them more likely to reassess their price point and weigh feature and technology trade-offs.

For automotive marketers, this shift may require a reevaluation of what segments are being targeted within their advertising. One approach that can improve campaign efficiency is including “border” categories — areas where shopper intent may span adjacent segments. A buyer who once leaned toward a large SUV, for example, might now be considering a midsize model. Meanwhile, someone in the luxury tier may still want premium styling and features, but at a price point that is more reflective of a non-luxury vehicle. At Urban Science, we don’t just observe these trends in isolation — we consistently identify them through our deep visibility into sales and defections. A recent example involves an automotive brand marketing a midsize SUV. Although the brand’s site traffic was strong, users were dropping off at the build-and-price stage, indicating a disconnect between the targeted audience and those most likely to convert.

In this case, we recommended the client refine its targeting to include not just traditional buyers for the nameplate, but also luxury intenders. These consumers, while not originally a part of the core audience, were financially qualified and potentially more motivated by value than in the past. Broadening the audience in this way helped align the product with the realities of current auto-buyer demand and engage shoppers who were actually in-market.

Evolving with the market

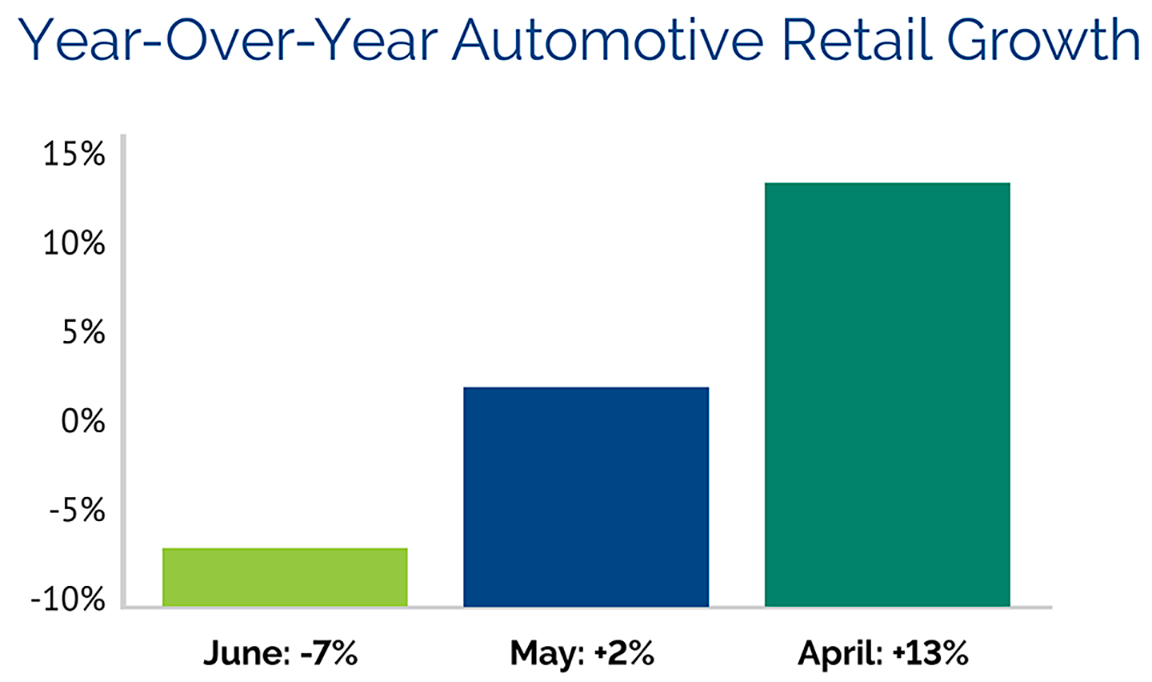

With consumer behaviors and market dynamics evolving so quickly, shopping patterns can shift meaningfully from one month to the next. The close of Q2 illustrated this clearly: While industry retail sales rose 13% year -over -year in April, growth slowed to just 2% in May and declined by 7% in June. For marketers, these fluctuations highlight the importance of working with data partners who are in tune to the most recent consumer behaviors and actions. Today more than ever, there is a premium to removing those who have already made a purchase and identifying potential buyers whose behavior and intent align with of-the-moment shopping trends. By leveraging audiences that adjust dynamically to real-world market signals, advertisers can avoid wasting spend on those who are no longer in-market and maintain relevance with those who are.

A strategy built around this level of responsiveness requires both regular refresh cycles and data inputs that are timely and accurate. Monthly audience updates, for instance, are only useful if the underlying data they rely on is recent; otherwise, the segment may reflect conditions that are already obsolete due to targeting informed by weeks- or months-old registration data.

Dealers echo this need for timely and accurate targeting. According to the Harris Poll findings, nearly 1 in 3 consider monitoring marketing effectiveness the biggest issue they’d like their performance tools to address, and 39% say their top challenge in managing their advertising efforts is measuring the impact of paid media on sales. As shopping behaviors continue to shift, staying in sync with the market will depend on manufacturers’ and marketers’ ability to recognize and respond to changes as they happen, ideally through the use of audiences that update automatically, requiring little to no manual intervention.

Better data means better audiences

As manufacturers, agencies, marketers and dealers look for ways to stay responsive in a fast-moving marketplace, many are turning to artificial intelligence (AI). In fact, according to the Harris Poll research, nearly 90% of dealers are either already using or plan to use the technology. But while excitement around AI is growing, it’s important to recognize the technology is only as powerful as the data it’s trained on. Predictive models require timely, high-quality inputs to surface the right signals and drive efficient and effective campaigns.

At Urban Science, our In-Market Audiences™ leverage daily sales data with demographic and financial indicators — such as net worth, home ownership, discretionary income and luxury propensity — to identify consumers with a higher likelihood of making significant purchases. When combined with our predictive capabilities that estimate a household’s tendency for specific vehicle segments, brands or models, this approach enables advertisers to focus their efforts on consumers who are not only financially capable and ready to buy, but also actively in-market for the vehicles being promoted.

Right buyer, right time

At its core, effective targeting is about reaching people with a message that is truly relevant to them. That starts with understanding what motivates them, what might hold them back and what will resonate. With more options at their fingertips and added stress from economic conditions, today’s consumers are often making purchase decisions faster than before.

That means for advertisers, the pressure is on. The best way to capture demand is by identifying the buyers most likely to purchase and reaching them with timely, targeted messaging that speaks to their affordability concerns. Relying on outdated technology or static audiences rooted in obsolete data increases the risk of missing out on opportunities to drive measurable outcomes. But with the right data and a clear understanding of their audience, advertisers can move with the market, maintain relevance and connect with the buyers who are ready to act.

Learn more about Media Performance and its ability to deliver prescriptive impact across the automotive media ecosystem.