-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- RESOURCES

- NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

December 10th, 2020

Continuing through COVID:

Are consumer car buying intentions changing all that much?

Urban Science recently commissioned a survey with The Harris Poll to understand how — and if — the pandemic is impacting consumer buying behaviors. Are consumers shifting to a total digital experience? Is the future gloomy for brick-and-mortar dealerships as a result? We’ve uncovered some surprises. Here is a sampling of the insights we learned.

The rise of pandemic fatigue – and foot traffic.

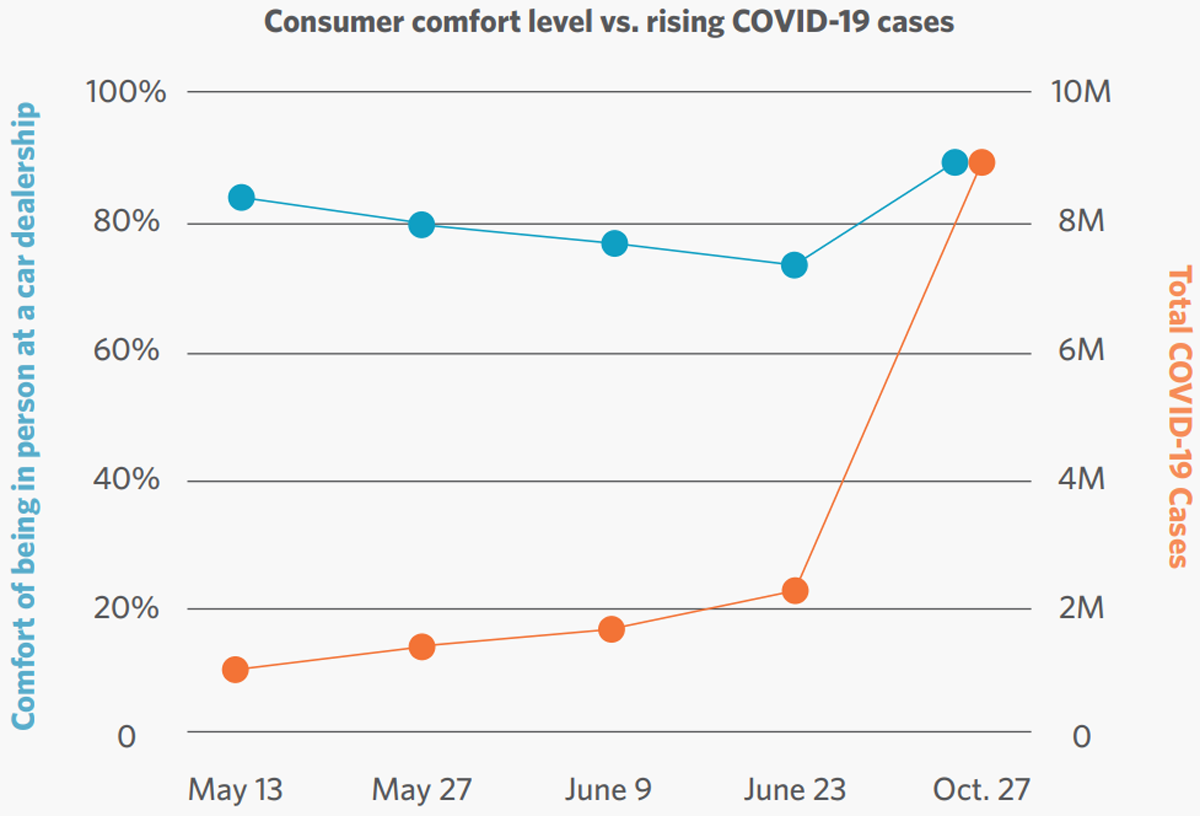

As consumers move into the ninth month of the Coronavirus pandemic, they are growing increasingly comfortable with visiting dealerships despite the dramatic rise in cases. In fact, 64% believe it is completely safe to go to a car dealership today and 42% are reportedly comfortable visiting a car dealership in-person within the next month or sooner, or even today.

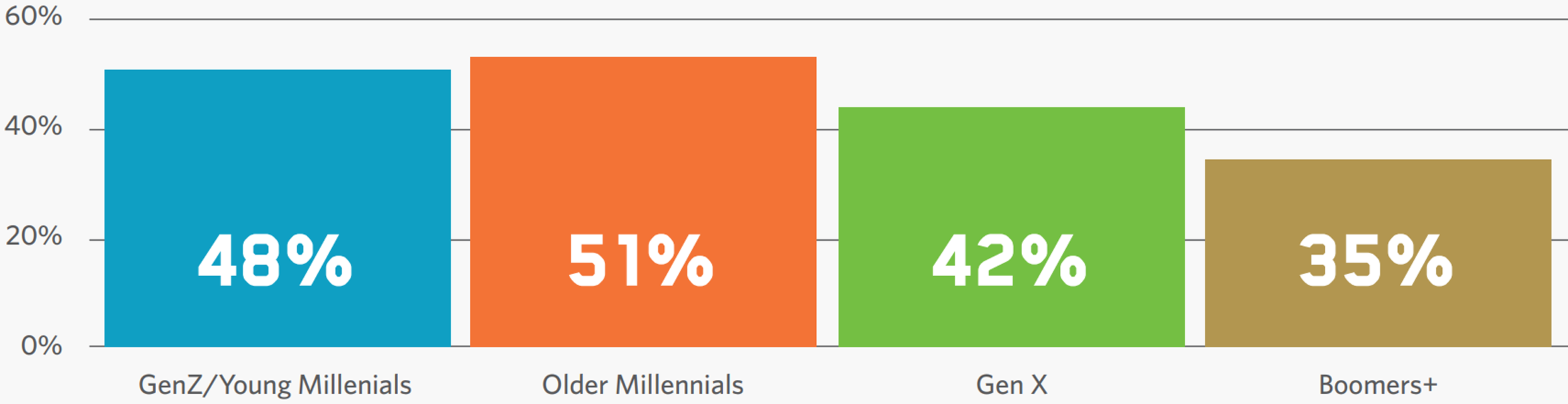

Consistent with earlier survey results, younger generations continue to be more likely than their counterparts to be comfortable visiting a dealership within the next month or sooner.

Generational comfort with visiting a car dealership within the next month or sooner

A surprise for big cities

More than half of adults (56%) agree that now is a great time to purchase a vehicle, but only 27% say they intend to do so within the next year.

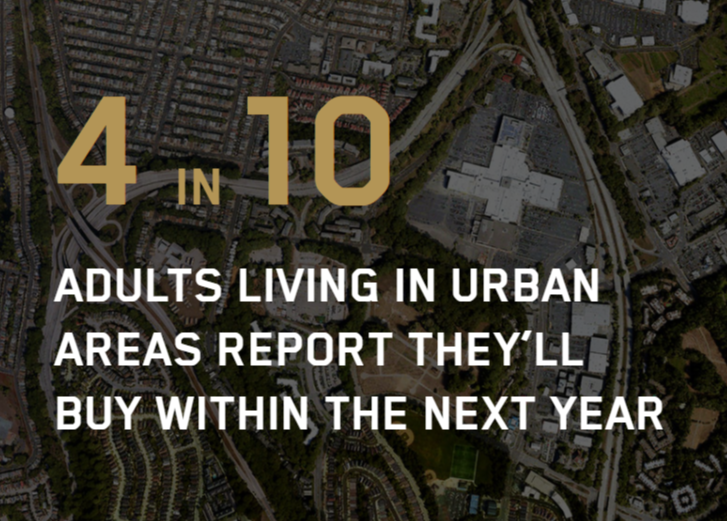

Interestingly, we found that city dwellers are the most motivated to buy. In fact, 4 in 10 adults living in urban areas report they’ll buy within the next year — twice as many as those in suburban (21%) and rural (21%) areas. Adults in urban areas are also less likely to buy used (29%) and more likely to be comfortable visiting a dealership in the next month or sooner (47%).

And the winner is… used cars!

Although most future vehicle intenders say they will acquire a new vehicle, more than half of adults (55%) say it is smarter to purchase/lease a used vehicle instead of new at this time.

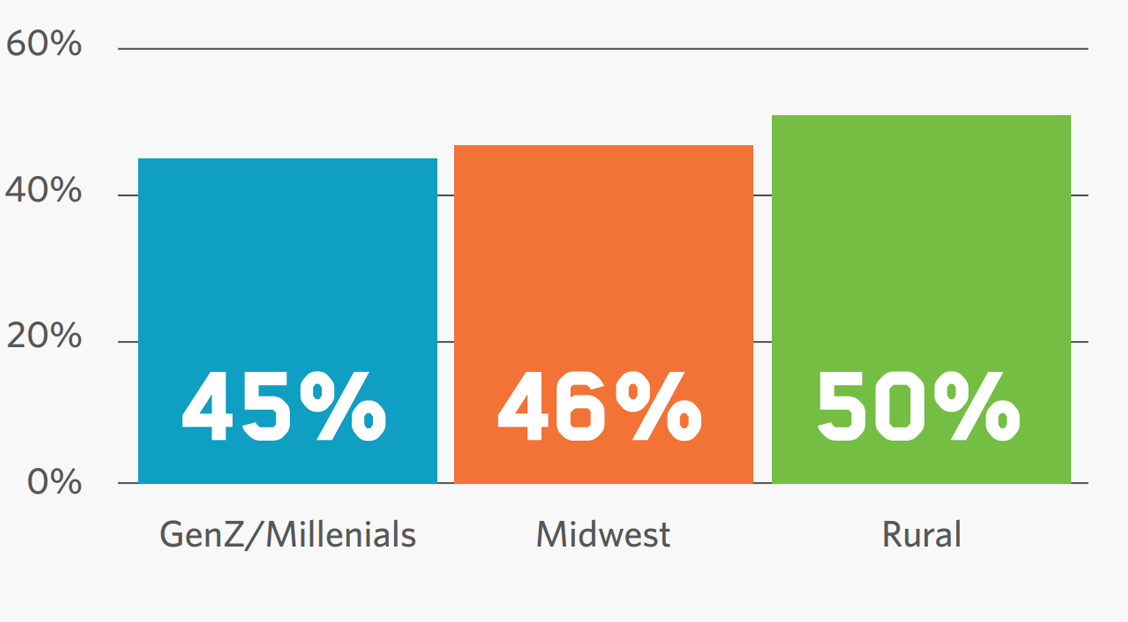

Nearly 5 in 10 are more likely to buy used:

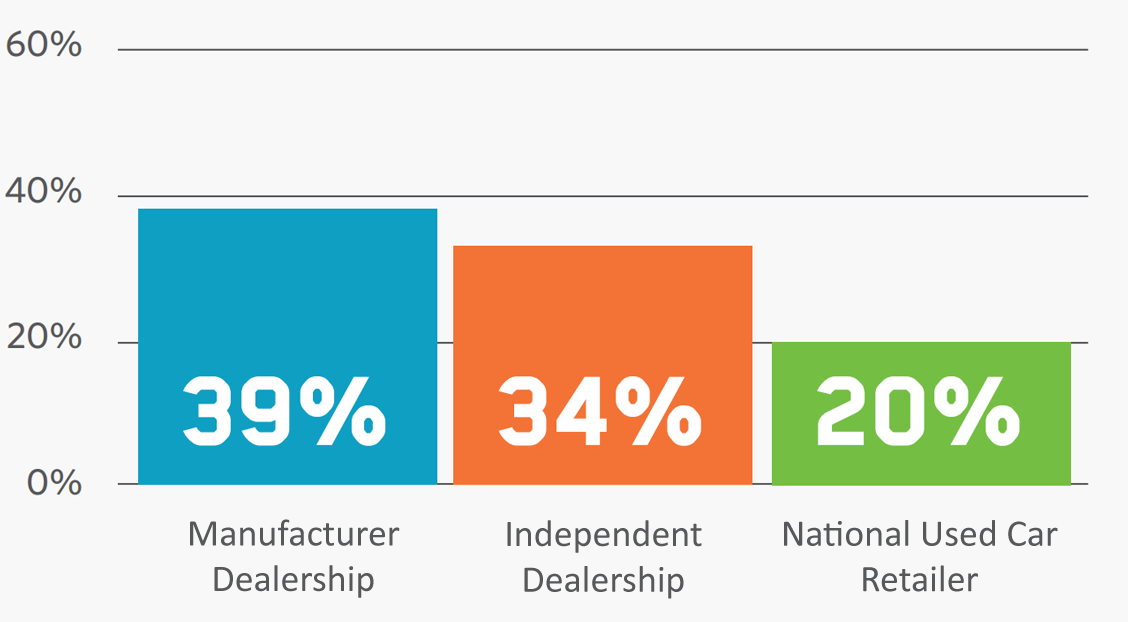

When asked where they would most likely acquire a vehicle from, used vehicle intenders are split:

For adults planning to purchase/lease within the next year, the independent dealership — your local mom & pop shop — jumps to first place (41%), followed by manufacturer dealerships (31%) and national used car retailers (21%).

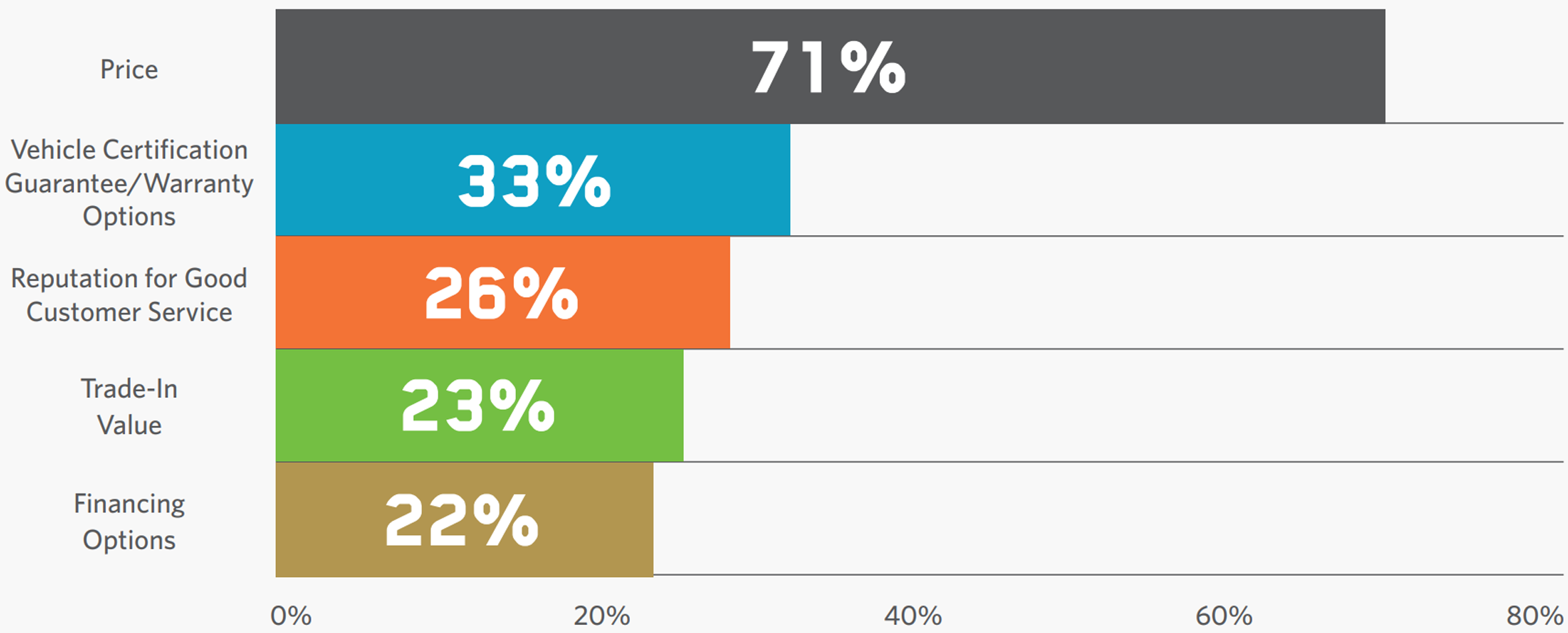

What is the most important consideration for used vehicle intenders when they’re deciding where to buy? 71% say it’s price, by far.

Top considerations when choosing a dealership to buy a used vehicle from

1 IN 4

ADULTS LIVING IN SUBURBAN AREAS ARE MOST LIKELY TO BUY FROM NATIONAL USED CAR RETAILERS

TRUE OR FALSE:

Consumers Want to Buy a Car Exclusively Online?

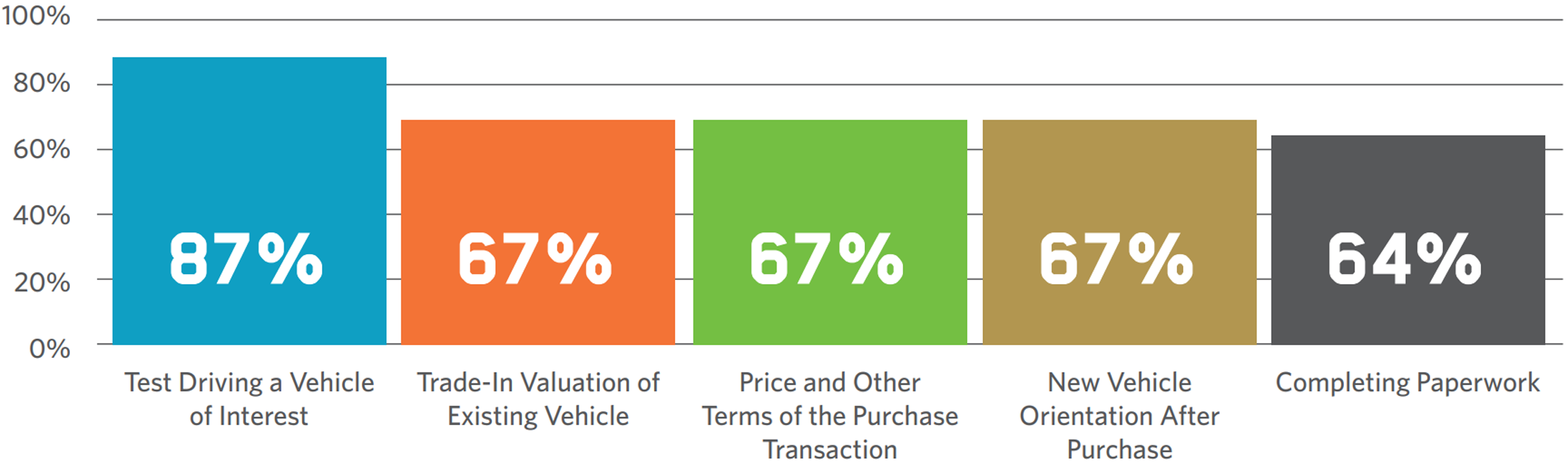

False. While some aspects are preferred to be completed online, most adults say that in-person at a dealership is the most helpful to ensure a positive experience, especially when it comes to:

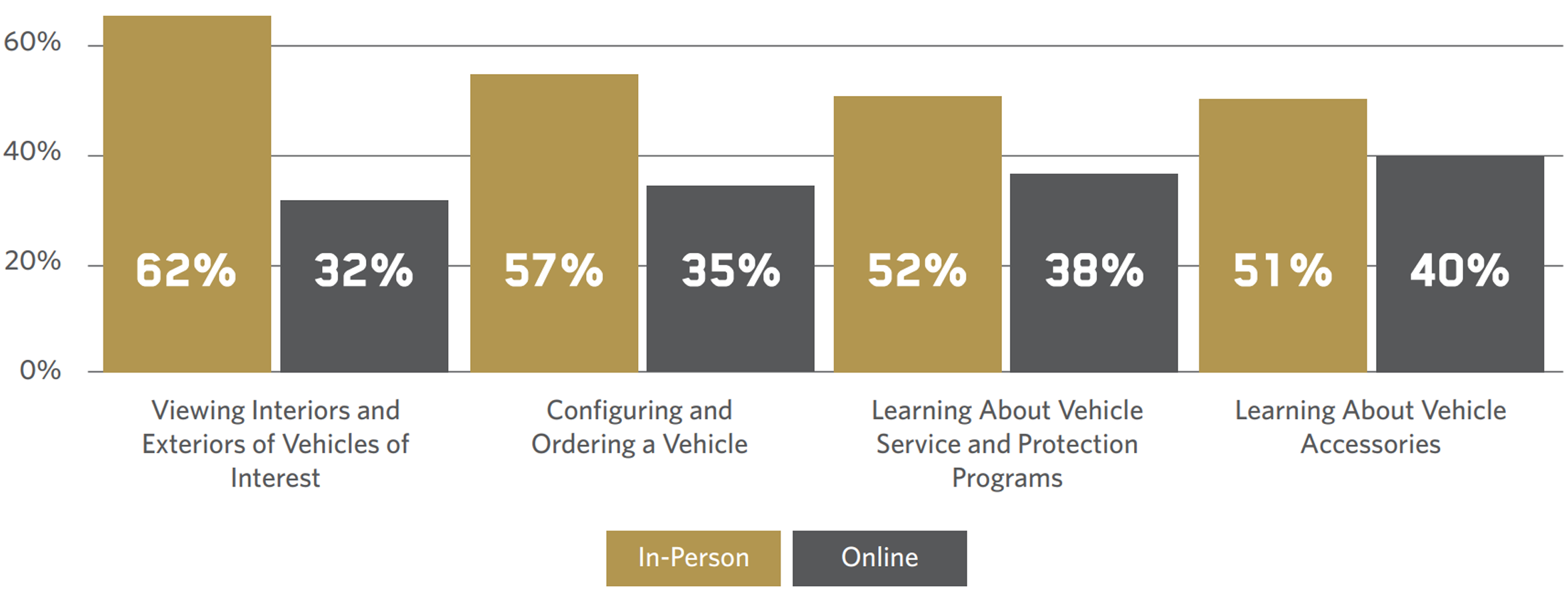

The gap between in-person and online starts to shrink for:

There is one step in the car buying process that adults strongly prefer to conduct online – research. 6 in 10 adults report preferring to conduct their research through a car dealership’s website was preferred over in-person (33%) and over-the-phone (7%) options.

Consumers want flexibility from dealers through providing them with purchase and service options that meet their needs and are respectful of their time. They want to physically interact with the brand and test drive the vehicle but want greater efficiencies during the purchase process. A parallel, near-seamless digital and physical ‘swim lane’ strategy would provide the ultimate convenience and further help selling efforts, letting consumers jump from one to the other as desired. Time-consuming activities such as contracts and paperwork are performed online, with brand experience and test drives at locations well placed for convenience.

Survey method:

This survey was conducted online within the United States by The Harris Poll on behalf of Urban Science from October 27-29, 2020 among 2,025 U.S. adults age 18 and older. Figures for age, gender, education, income, race/ethnicity, region, size of household, marital status, and internet usage were weighted where necessary to bring them into line with their actual proportions in the population. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.

For more information or questions on the insights learned from this survey, contact: lawaller@urbanscience.com.