By Paul Dillamore, Managing Director, Urban Science European Business Unit

As published in Auto Retail Network, United Kingdom

Much has already been written about the possible move from franchise to agency in automotive. With relatively few case studies to draw data from, educated speculation abounds. What is clear is that any significant move to agency will create a disruption to a car-selling dynamic that has existed for almost as long as cars have.

The change is being accelerated by the vehicle manufacturers’ overwhelming desire to gain control over an increasingly omnichannel buying journey. Along the way, it is becoming apparent that efficiencies in a notoriously thin-margin business model could be realized – efficiencies that would benefit manufacturer and dealer alike. But what would actually change day-to-day in a typical dealer’s business under an agency construct? Which of those changes bring welcome relief and which have the potential to make the game tougher?

A change of this magnitude also brings uncertainty. Dealers work with a pre-specified product and sell that product to a largely pre-defined market, but they currently have control over a number of levers – for example, price, marketing and offers, inventory – that dictate the success of their sales business. Strong local new car sales have a positive impact on used car business and ultimately have a positive impact on the serviceable local vehicle parc, a critical part in the dealer’s current business model. Agency certainly reduces the number of levers at the dealer/agent’s disposal to control new vehicle sales performance, moving those levers into the hands of the manufacturer.

There will be a fear that this loss of dealer control will adversely affect sales volumes. Even in a model where sales generate commission rather than a retained margin, the number of units sold is the key multiplier, especially when each sale has the potential for further revenue downstream.

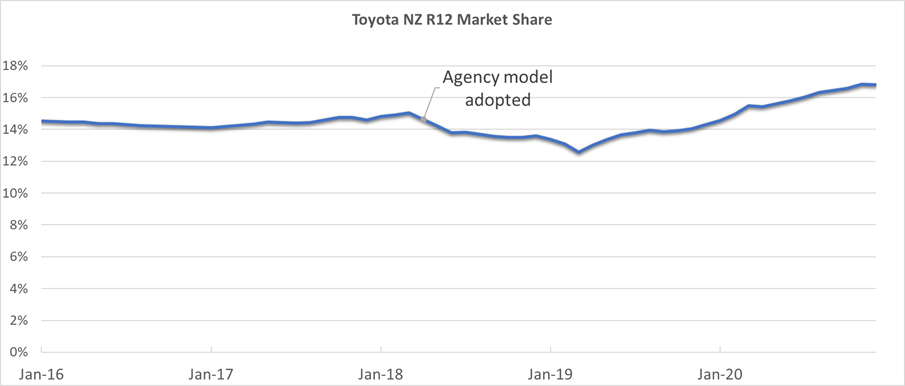

Here, we do at least have some data that could put dealers’ minds at rest. Toyota switched to the agency model in New Zealand on April 1, 2018. In the 12 months that followed, Toyota’s market share of private registrations dropped from 14.6% to 13% – but then bounced back in the next 12 months to reach 15.4% – before continuing to rise again to 16.8% by the end of 2020.1

It remains to be seen what would happen in a market where more than one brand makes the shift in the same time-frame, but as with any other competitive marketplace, there will be winners and losers. It seems unlikely though that shifting from franchise to agency will be the sole deciding factor in a brand’s performance.

Although some consumers will no doubt regret the lack of opportunity to negotiate the price of their vehicle, as long as the value proposition is strong, the majority will not. This will likely offset any adverse impact of a marginal increase in price. Agents will be able to concentrate on providing outstanding customer service and support to differentiate themselves. This will require at least a different focus, and at most an entirely different set of skills. Currently, the new vehicle sales department in a typical dealership might account for 40-50% of the total dealership cost yet generate only 20-30% of the profit. Agency could allow this skew to be righted. On the other hand, most analysts agree that used vehicle sales and aftersales would remain largely unchanged under agency agreements.

Dealers or agents (in the future) are likely to remain an essential link to automotive customers. We can look again at data from Toyota in New Zealand to see that dealer count has remained largely unchanged pre- and post- the switch to agency. This should allay some more dealer fears, but of course, manufacturers will constantly assess the number and location of dealers or agents they need. Agency could give manufacturers the ability to have their brand represented in locations that have been difficult to viably franchise in the past. This will be interesting to watch; moving the cost of stock away from dealer balance sheets will certainly change the financial model significantly enough to allow for this. An eventual shift to more and more consumers buying to order could see small sites in more expensive locations become attractive. At the least, we can expect a shift from franchise to agency to prompt a network review but, as with other retail environments, being physically closer to potential buyers than your competitors is still an advantage – this is particularly true in automotive where the service requirements remain so critical.

- Motor Industry Association, Sales Data, Vehicle Sales https://www.mia.org.nz/Sales-Data/Vehicle-Sales#msm