National electric vehicle (EV) retail sales volume rose by 26.9% year over year in the third quarter of 2025, according to data from Urban Science. However, while EVs are making headlines, not all markets or demographics are embracing electric powertrains at the same pace. A large portion of EV sales growth is concentrated in a limited number of metro areas across the country, driven by factors such as charging infrastructure and state-level incentives.

As tax policies shift and new global competitors enter the market, original equipment manufacturers (OEMs) face mounting pressure to adapt and win market share. To stay ahead, they need clear insight into where demand is growing now, where it’s expected to grow next, and the key drivers of EV adoption — so they can strategically focus their resources in regions that support both short- and long-term success.

The Cost Factor in EV Adoption

At the retail level, U.S. auto dealers continue to demonstrate confidence in the EV segment’s potential. The 2025 Urban Science Harris Poll Study* fielded earlier in the year found almost 80% of dealers plan to increase their EV focus, and 87% have seen revenue growth from EV sales in the past five years. On the other hand, auto buyers are more hesitant to embrace electric powertrains, with less than half saying they will be ready for EV-only options by 2040. Many also remain wary of the costs and logistics of ownership.

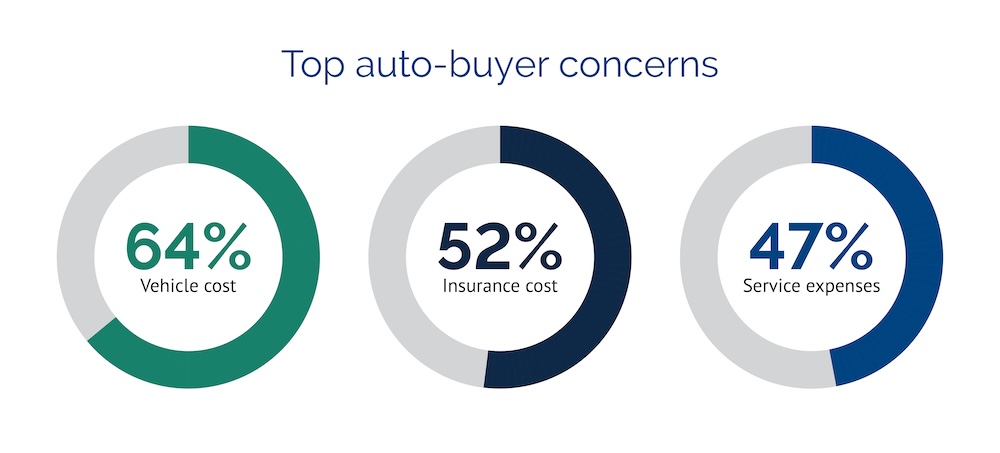

Affordability tops the list of auto-buyer concerns. Nearly two-thirds (64%) of auto buyers cite vehicle cost as the primary barrier to buying or leasing a vehicle, followed by insurance costs (52%) and service expenses (47%). Policy uncertainty is adding to this pressure. One-third of auto buyers now say they are less likely to purchase an EV in 2025, citing the potential impact of tariffs and reduced government support.

Yet, even as policy shifts threaten to drive up costs, EVs are becoming more affordable. Some automakers are leaning into affordability with leasing programs designed to bring more buyers into the market. For example, Chevy’s Equinox EV leasing deals make monthly payments attainable for buyers who may have viewed EVs as out of budget.

The Link Between Charging Infrastructure and EV Readiness

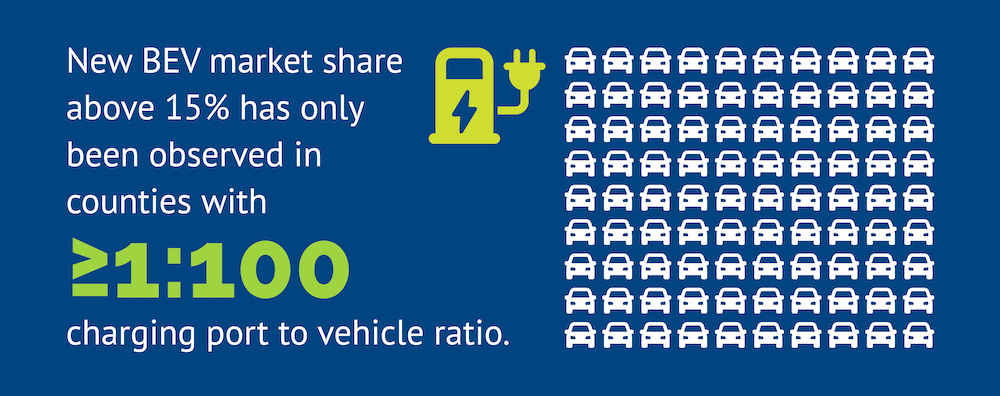

Affordability is not the only factor driving demand for electric vehicles. Adoption is most pronounced in major metropolitan areas—particularly along the West Coast, as well as in states like Colorado and Florida, and cities such as Atlanta, Dallas–Fort Worth and the Washington, D.C. region. These markets tend to benefit from state incentives and robust charging infrastructure. Urban Science’s analysis of the 100 most populated counties in the U.S. from June 2024 to June 2025 shows a clear correlation between charging availability and retail BEV market share. New vehicle battery electric vehicle (BEV) market share above 15% has only been observed in counties with at least one charging port per 100 new vehicle sales.

Charging infrastructure plays both a practical and psychological role in consumer readiness and adoption. Some EV owners, such as home renters who are unable to install chargers at their place of residence, rely on public charge points to power their vehicles. But even for drivers who rarely use public chargers, the visible presence of charging stations reinforces the perception that EVs are viable in their market.

Because EV sales are heavily influenced by regional trends and infrastructure, having clear, timely, localized EV sales data is essential for automakers weighing how and where to introduce and scale EV programs. Urban Science’s MarketView™ EV Dashboard gives OEMs and their dealers a real-time view of industry-wide EV sales performance. By isolating EV-specific daily sales volume data and overlaying data points like charging station locations, users can identify areas where opportunities may exist to capture new or additional market share.

How Hybrids Feed the BEV Pipeline

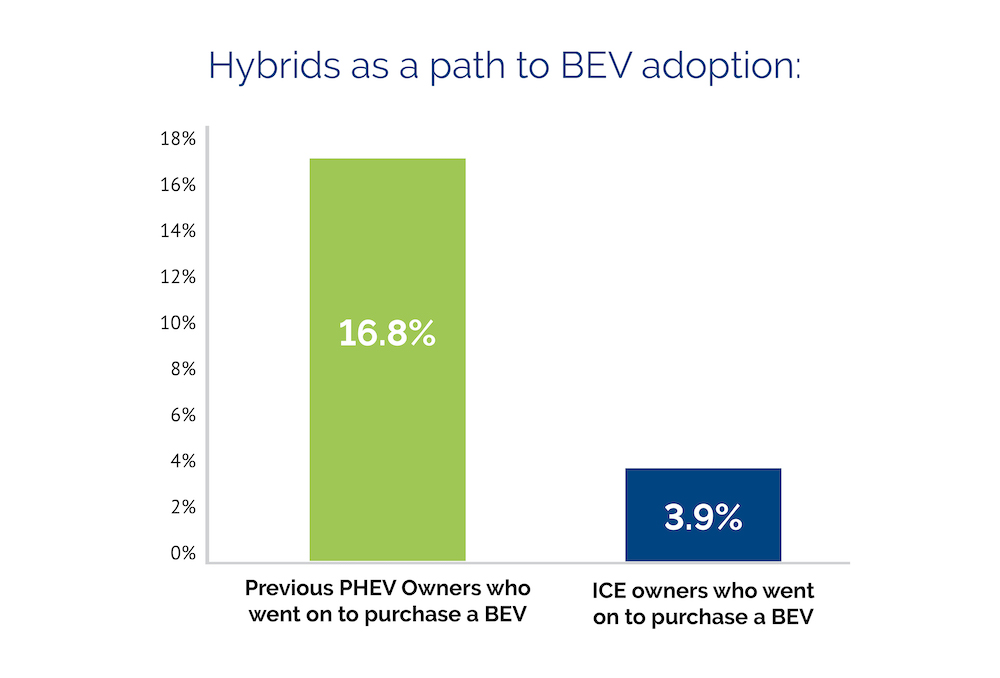

Although well-designed incentives and convenience-driven charging infrastructures can ease common buyer concerns and promote widespread adoption, many consumers simply aren’t ready to move directly to a BEV. For these buyers, hybrids offer a bridge between traditional internal combustion engine (ICE) vehicles and BEVs. According to our research, 39% of auto buyers think hybrids are a better option than EVs right now and believe automakers should prioritize them.

Urban Science’s analysis of purchase history and household-level data reveals how hybrids could help build long-term EV momentum. Of buyers who previously owned a plug-in hybrid electric vehicle (PHEV), 16.8% went on to purchase a BEV. In contrast, only 3.9% of ICE buyers made the same switch, suggesting hybrid buyers are a key feeder group for future BEV growth. Informing sales and network planning strategies with daily industry sales data can help automakers understand where these households are concentrated and how their behavior trends over time. This provides the insight OEMs need to pinpoint where hybrid ownership is most likely to lead to BEV sales.

Leveraging Sales Data to Win Market Share

Across the U.S., EV demand is following clear, data-backed patterns. Adoption is strongest in regions where charging stations are visible and dependable. Consumers want charge points that are easy to find, compatible and operational when they need them. Affordability continues to play a major role in influencing who buys EVs with lower-cost models and leasing options becoming a practical way to reach new audiences. At the same time, many consumers still aren’t ready to fully transition to a BEV. For this resistant group, hybrids represent a practical entry point that can help build long-term momentum toward electrification.

As the next chapter of electrification unfolds in the U.S., automakers can tap daily industry sales data to see how regional demand, infrastructure and readiness intersect. This data can empower EV strategies behind inventory, incentives and regional investment. Armed with this insight, OEMs can win emerging opportunities and grow their existing market share in the regions with the most potential.

Explore Urban Science’s MarketView EV Dashboard to see how EV sales and charging insights can accelerate your path to smarter planning, stronger networks and sustainable market share.

*This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,026 US adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”) and 254 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager or Principal/VP/Owner.

The auto-buying public surveys were conducted from January 10 to February 4, 2025. Data are weighted where necessary by demographics to bring them in line with their actual proportions in the population. The dealer survey was conducted January 9 to January 30, 2025. Data were weighted as needed based on the average of current and previous waves for gender, car types sold, job title and urbanicity.

The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ±2.2 percentage points for U.S. auto-buyers and ±7.1 for U.S. OEM automotive dealers using a 95% confidence level.