Europe has become a magnet for new automotive entrants. On forecourts from Lisbon to Lyon, you now see cars from Chinese brands like BYD, NIO, SAIC, Chery, Xpeng and Leapmotor parked alongside Volkswagen and Renault — something almost inconceivable just five years ago. Their rapid expansion has surprised an industry that, until recently, believed long-established names would continue to be Europe’s chosen brands.

Data shows electrified vehicles accounted for 15.6 percent of all retail sales in Q3 2025, a rise of over 3 percent year-over-year. Much of this growth has come from new entrants that are pricing aggressively, scaling quickly, implementing digital-first sales models and capitalizing on Europe’s accelerated shift toward electric mobility.

High fuel prices, stricter emissions standards and generous government incentives have made Europe a natural entry point for EV specialists. The reduced complexity of electric drivetrains has also lowered manufacturing barriers. New players can now build, export and sell vehicles faster than ever before.

However, early success is not the same as staying power. The coming years will reveal whether these newcomers can sustain their momentum once the first wave of attention and enthusiasm fades.

Momentum Meets Surface Tension

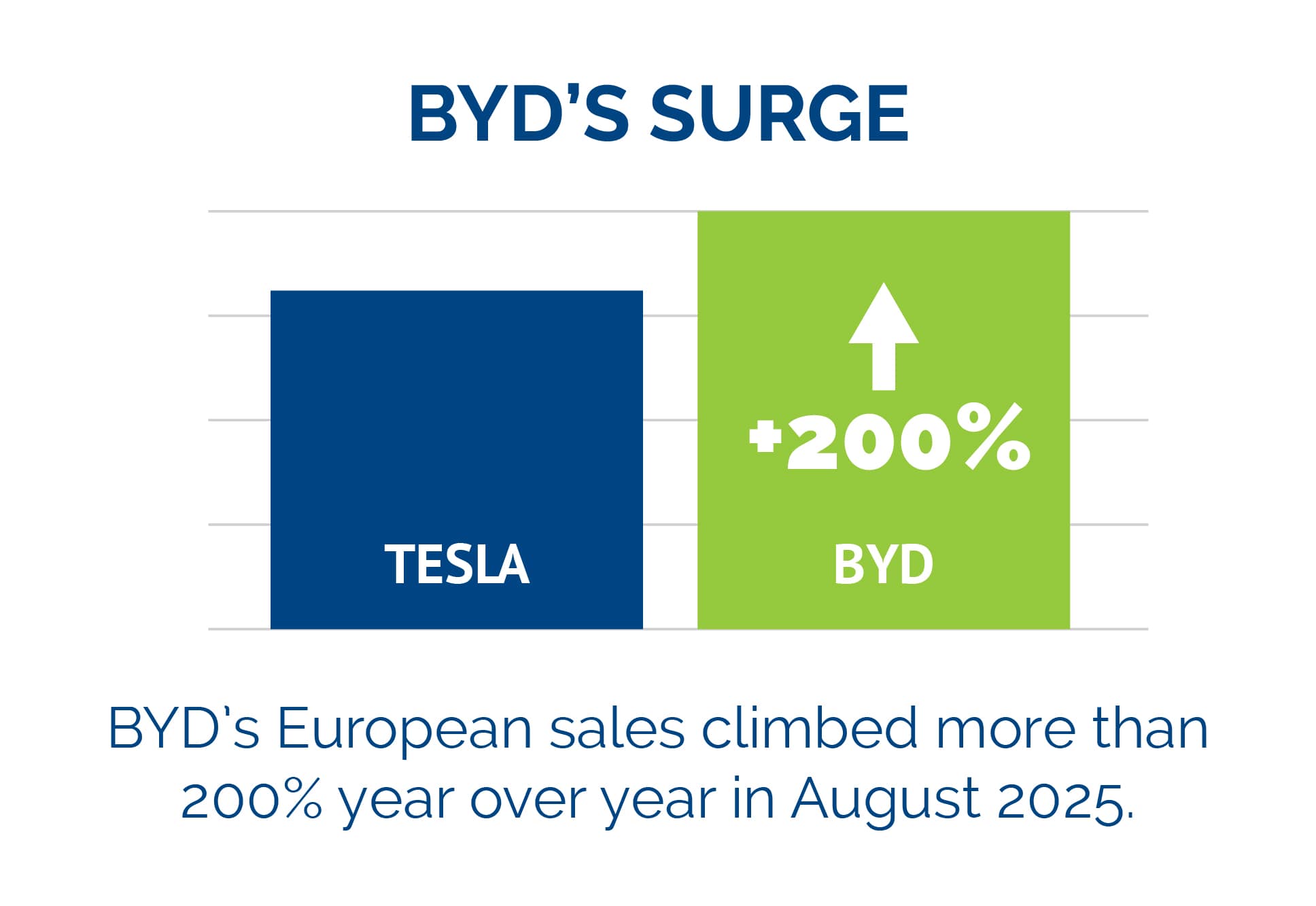

In many markets, new brands are already performing better than expected. BYD’s European sales climbed more than 200 percent year-over-year in August 2025, briefly overtaking Tesla’s share in several countries. MG, once a nostalgic British brand now backed by China’s SAIC, currently ranks among Europe’s top ten brands by volume. Their vehicles compete directly with models from legacy Original Equipment Manufacturers (OEMs), often at lower prices and with longer battery warranties.

However, the rapid pace of expansion has exposed weak points in service and support models. Building a vehicle up to European standards is one challenge, but delivering a consistent ownership experience across dozens of diverse markets is another. Many new entrants still rely on small dealer networks—often appointed by independent importers or a National Sales Company (NSC)—for service and logistics. When these networks are stretched thin, delivery delays and warranty backlogs quickly follow. Parts distribution may be managed by the NSC or importer, but for low-volume brands it is often outsourced to third-party specialists.

For now, Chinese brand sales are strong, with a record-setting 7.4 percent combined market share in September 2025. Brand interest is high and early adopters are eager to try something new. But once owners return for repairs or maintenance, what matters then is not cost or vehicle range, but the quality of aftersales support. One of the main reasons European auto buyers are hesitant to consider a new EV brand is the limited availability of service and support — 46 percent in Germany and 42 percent in the United Kingdom.

The Aftersales Pressure Point

Aftersales is emerging as the true test for Europe’s new automakers. According to the 2025 Urban Science Harris Poll Study*, 34 percent consumers in Germany and 25 percent in the UK reported receiving a multi-point health check the last time they had their vehicle serviced, yet up to 74 percent said they purchase all or some of the recommendations provided when they do get an inspection. For established brands and new entrants alike, that figure represents lost opportunity.

Many newcomers are learning how a lack of trained technicians or local parts depots turns small issues into large disruptions. In some markets, wait times for warranty repairs have doubled as service centers struggle to keep pace with rising sales volume. Customer trust and patience can wear thin when even basic maintenance takes a prolonged period to complete.

The lack of an aftersales presence was a notably present challenge in NIO’s delay of its planned EV launch in early 2025. The company publicly acknowledged the postponement was due to “underestimated challenges involved in sales and service network expansions in the region.” Other manufacturers are facing similar decisions as they balance expansion with the realities of customer care.

Legacy Brands Confront a New Kind of Pressure

Europe’s established automakers face their own challenge of maintaining profitability as the market rapidly shifts toward electric powertrains. EVs require less maintenance than combustion models, reducing the service revenue that has long supported dealer margins on the continent.

In response, many legacy manufacturers are reshaping how they think about aftersales. Subscription-based maintenance plans, predictive diagnostics and extended warranties are becoming tools to sustain loyalty and stabilize revenue.

The Power of Trust and Data

Trust remains the strongest advantage for established OEMs. A Renault driver in France or a BMW owner in Austria knows reliable service support is available nearby. That confidence, built over decades, is something no new entrant can replicate quickly.

Our research shows across Europe’s largest markets, trust in service quality ranks among the top three factors influencing repurchase decisions. When customers know a brand can deliver reliable service, they are far more likely to remain loyal, even when cheaper options become available.

Data and connectivity are now expanding what trust can mean. Modern vehicles constantly send information about performance, maintenance needs and usage patterns. When manufacturers use data responsibly, they can anticipate issues before they occur and stay connected to customers through personalized updates and offers.

Urban Science’s ServiceView solution helps European OEMs manage and optimize their service departments by providing a data-driven view of retention, parts sales opportunities and future service capacity. In a competitive field where many cars look and perform alike, data clarity has become a big differentiator, allowing OEMs and their dealers to highlight where opportunities lie.

How Market Leaders Can Make Their Move

Legacy automakers and dealer networks in Europe still have a real advantage, and an overwhelming majority of market share. But they must act intentionally, not defensively.

Consider the following tactics:

Bridge the trust gap through consistency

Even new brands recognize consumers hesitate without a safety net. Legacy OEMs should highlight repair coverage zones, localized parts network reliability and warranty responsiveness as brand assets.

Use data to fight fragmentation

When your data flows show Region X is losing share to a new entrant, jump in early with targeted loyalty incentives or dealer-level investment before consumers jump to another brand.

Pilot hybrid dealer strategies

Forward-thinking dealers are already providing service for multiple brands, traditional and new. Where regulatory frameworks allow, doing so can monetize vehicle influx while exposing new brand customers to your superior service standards.

Accelerate connectivity maturity

Ensure over-the-air updates, telematics health and predictive prompts provide real value. Make it simple for customers to stay in-network and feel cared for over time.

The Moment of Truth

Europe’s new entrants have made a remarkable first impression. Their vehicles are competitive, their strategies are bold and their presence has made the continent’s car market more dynamic than it has been in decades. Even so, the industry measures success in cycles, not quarters. The next phase will test whether these companies can evolve from rapid sellers into reliable brands.

Several new entrants are already taking steps. BYD has begun developing assembly and distribution centers in Hungary and Turkey to shorten delivery times and strengthen regional supply, and MG continues to grow its dealer network across Western Europe to ensure faster service coverage. Omoda also looks poised to expand into new segments with a stronger European focus, building on its early success in the region. These investments suggest these new brands are recognizing long-term growth depends on ownership satisfaction, not just sales performance.

Legacy automakers must move beyond relying on heritage. They still hold the advantage in trust, infrastructure and institutional knowledge, but the market will favor those using data and technology to modernize the experience. The brands that last in Europe will treat every sale as the beginning of a relationship and every service call as proof they deserve to stay.

*This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,026 US, 1,008 German, and 1,010 UK adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”) and 254 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager or Principal/VP/Owner.

The auto-buying public surveys were conducted from January 10 to February 4, 2025. Data are weighted where necessary by demographics to bring them in line with their actual proportions in the population. The dealer survey was conducted January 9 to January 30, 2025. Data were weighted as needed based on the average of current and previous waves for gender, car types sold, job title and urbanicity.

The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ±2.2 percentage points for U.S. auto-buyers, ±3.8 for Germany auto-buyers, ±3.5 for UK auto-buyers ±7.1 for U.S. OEM automotive dealers using a 95 percent confidence level.