Auto buyers are feeling the affordability pressure. What does that mean for dealers?

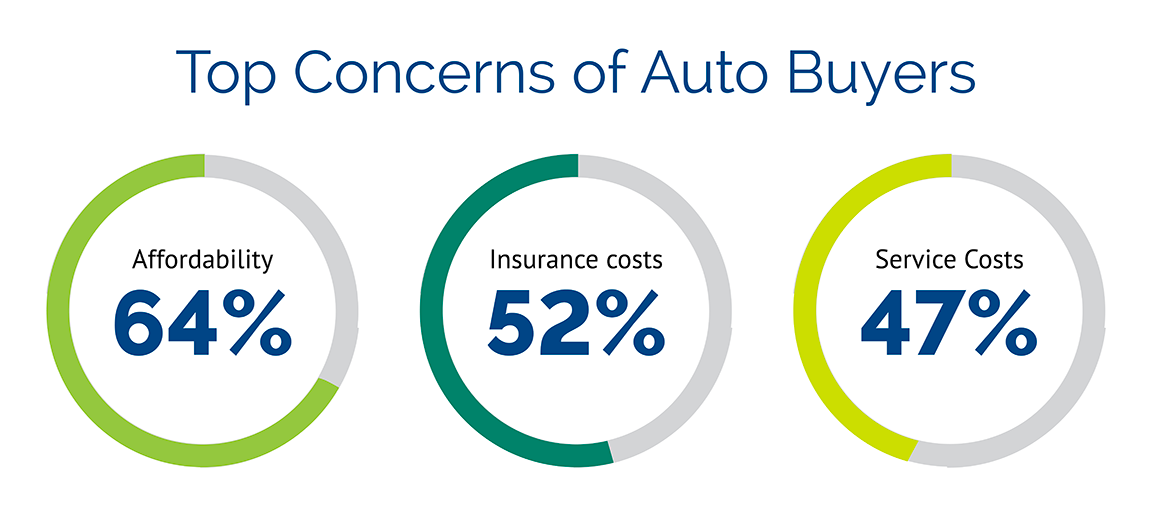

New vehicle affordability took a hit in April, with the average monthly car payment reaching $753, its highest peak since December. Between rising prices, new auto tariffs, elevated interest rates and stubborn inflation, consumers are feeling the pressure. In the 2025 Urban Science Harris Poll Study*, auto buyers ranked affordability (64%), the cost of insurance (52%) and the cost to service vehicles (47%) as their top concerns when considering a new vehicle purchase or lease.

Original equipment manufacturers (OEMs) are finding unique ways to address these anxieties. For instance, against the backdrop of price hikes for three of their vehicles, Ford announced its new “Zero, Zero, Zero” initiative (zero down payment, no monthly payments for the first three months and 0% interest for the first four years) in a bid to make auto purchases more accessible for buyers.

But what about dealers? Unlike OEMs, dealers have limited control over pricing or national incentives. What they can control, however, is their customer experience, and that’s where they can differentiate themselves. By focusing on the brilliant basics, such as consistent follow-up, clear communication and flawless execution of the sales process, dealers can create value and build trusted relationships, even in the face of affordability headwinds.

How affordability shows up in the showroom

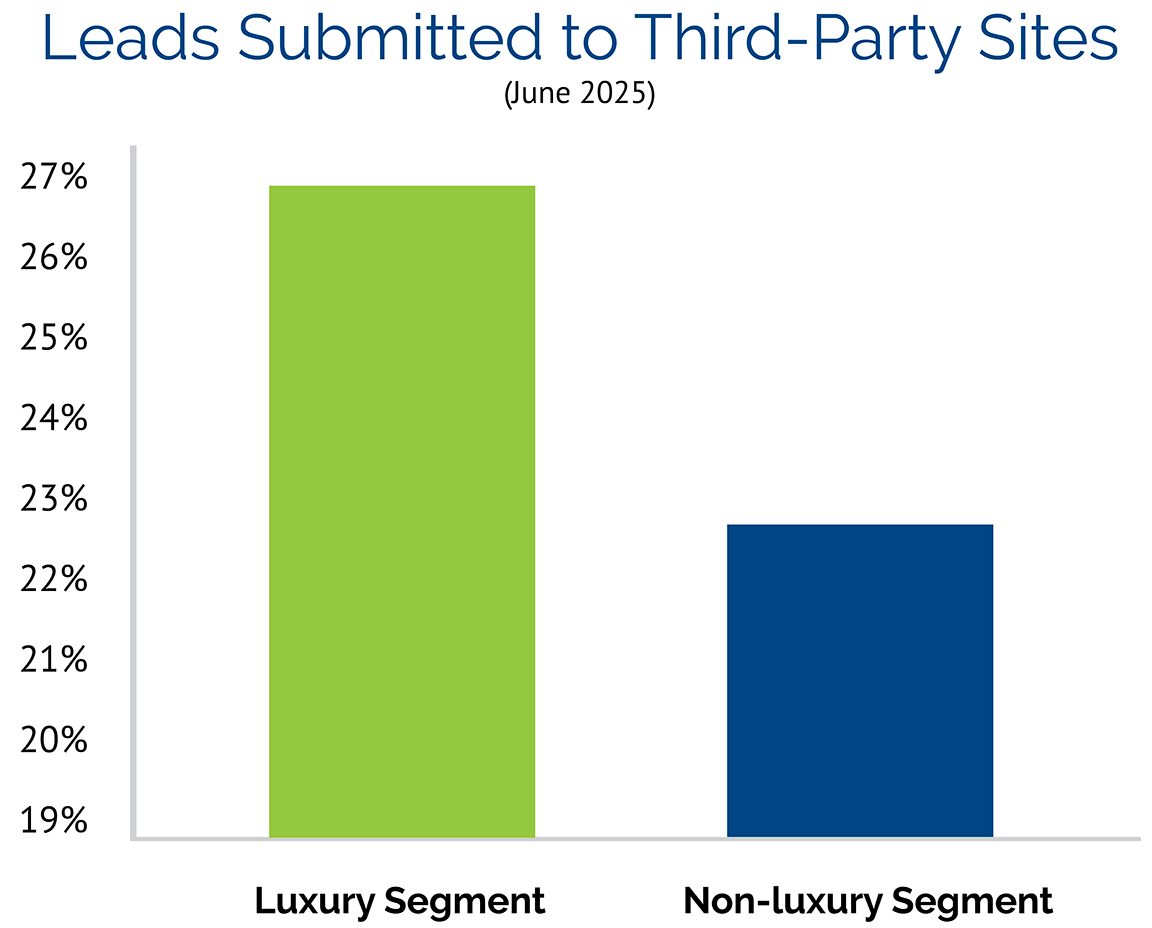

Affordability concerns are driving changes in customer behavior. Auto buyers are shopping more aggressively; submitting more leads; and comparison shopping payments, trade, financing and availability. In June 2025, consumer leads submitted to third-party sites increased by 26.63% year over year in the luxury segment and by 22.34% in the non-luxury segment. As lead volume rises, so does the rate of buyers defecting from the shopping process — reaching an industry average of 20.2% in July, a 36-month high — making effective follow-up more critical than ever to keep leads engaged with your store.

Dealers can’t address every factor contributing to buyer drop-off, some of which is caused by elevated shopping levels with more dealers being visited. Issues such as high interest rates or OEM inventory allocation are also outside of their influence. What dealers do own, though, is how effectively their team engages with leads. Are salespeople asking (and answering) the right questions? Are follow-ups taking place when they should? Are customers being presented with all the options, including more affordable nameplates or used vehicles, when pricing is a factor? These moments often determine whether a lead turns into an owner or is lost to a competitor.

We saw this dynamic play out during the pandemic. While dealers faced limited inventory and widespread economic uncertainty, some still managed to outperform others. What set the leaders apart? They considered what customers needed, then adjusted their sales process accordingly. When inventory was tight, they offered alternatives like certified pre-owned vehicles. These small but significant adjustments helped build trusted relationships with customers and gave salespeople more opportunities to connect with buyers, despite inventory challenges.

Turning lost leads into actionable insights

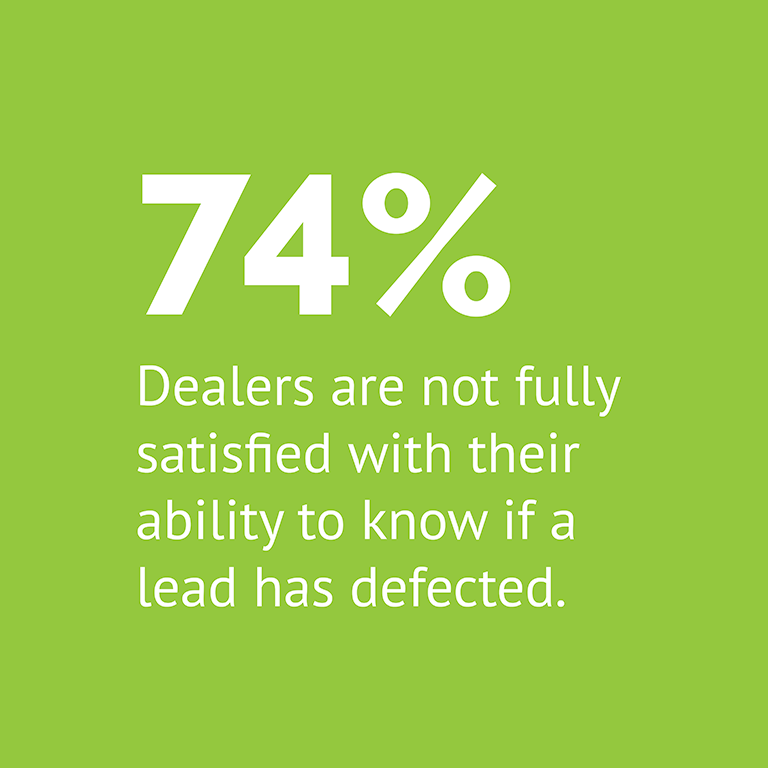

The ability to adapt, as many dealers did during the pandemic, depends on having a clear view of what’s happening in the sales funnel. Yet many dealers lack visibility into when and why their customers defect. According to The Harris Poll findings, 74% of dealers are not fully satisfied with their ability to know if a lead has defected. That makes it difficult to identify areas of weakness, coach sales teams effectively or adjust the sales process to better meet the needs of buyers.

When leveraged strategically, defection data provides valuable insight into where shopper engagement is falling short — not just at the dealership level, but down to the individual salesperson. TrafficView™ connects dealership CRM systems with our daily industry sales data, allowing teams to pinpoint when and where defections occur — and which competitors are closing those deals instead. With its salesperson-level view, TrafficView™ helps identify patterns in lead handling and performance. Are certain team members more effective with internet leads? Is the lead mix aligned with each salesperson’s strengths? These insights uncover opportunities for targeted coaching, smarter lead distribution and — ultimately — stronger close rates.

Meanwhile, SalesAlert™ notifies staff in real time when a lead has purchased elsewhere, enabling salespeople to refocus their efforts on buyers who are still in play. Together, these tools reinforce strong sales fundamentals by helping teams stay consistent, prioritize the right leads and follow through at the right time. By surfacing patterns in salesperson performance —such as lead mix effectiveness and training opportunities — they also support smarter coaching and more strategic lead distribution.

Embracing the brilliant basics

Offering the best customer experience isn’t just about winning on price. It’s about outperforming the competition at every stage of the funnel. Success comes from salespeople getting the basics right: communicating well, prioritizing timely follow-through and, if necessary, adapting their approach to respond to customer needs. However, to improve the sales process, dealers first need to understand where it’s breaking down. Defection doesn’t have to be viewed as a failure. It’s a signal, and it offers valuable insight into performance and process gaps.

Realistically, affordability will continue to be a factor in buyer behavior, which means some level of defection is inevitable. The opportunity lies in how dealers respond. Those who embrace the data, drill down on the fundamentals and learn from every lost lead will be best positioned to compete. That starts with delivering on the brilliant basics, for every buyer, every time.

Learn more about Dealership Performance and its ability to uncover and activate dealer sales opportunities.